Introduction

Ever had to pay for car repairs, school fees, or a friend’s birthday gift — and it completely messed up your monthly budget? That’s where sinking funds come in.

A sinking fund is a smart way to organize your income and save money for upcoming future needs. Instead of getting hit by big expenses all at once, a sinking fund helps you prepare in advance by setting aside a small amount every month. Whether it’s an emergency medical situation, a vacation, a family dinner, or even a loan instalment — sinking funds keep you in control without borrowing money from banks or friends.

In this guide, you’ll learn everything about sinking funds: what they are, why they matter, how they work, and how to start your own — with real-life examples and a tracker to keep you on track.

Table of Contents

What is Sinking fund?

A sinking fund is a way to save a portion of your income for specific upcoming future needs — helping you cover those expenses when the time comes.

Or simply:

Sinking funds help you set aside money from your income to prepare for specific future expenses — so when the time comes, you’re ready.

Explanation

A sinking fund is an easy and smart way to save your money over time for a specific future expense. Paying a large amount all at once can be difficult — but the sinking fund technique helps you avoid that by saving a small portion every month.

This approach prevents you from taking on debt when those planned expenses come up, because you’re already prepared. Whether it’s car repairs, school fees, a friend’s birthday gift, or a yearly insurance payment — a sinking fund keeps you in control.

Example

Let’s say your family plans a yearly vacation and each person needs $1,200.

You have 6 months to save — so you divide your goal:

$1,200 ÷ 6 months = $200 per month

By saving $200 every month, you’ll have the full $1,200 ready when the trip starts — no stress, no debt, and no last-minute panic.

Emergency fund vs sinking funds

While both sinking funds and emergency funds help with financial stability, they’re very different:

- A sinking fund is well-structured and future-oriented. You divide your savings into different categories to meet known, upcoming expenses.

- An emergency fund, on the other hand, is not divided and is used for unexpected emergencies — like job loss or sudden medical bills.

| Fund Type | Purpose | Planned? | Example |

| Sinking Fund | Known future expenses | Yes | Travel, car repair |

| Emergency Fund | Unexpected surprise expenses | No | Job loss, medical bill |

| Savings | Long-term or flexible goals | Yes | House, business |

Why You Need Sinking Funds

Handling monthly expenses like rent, groceries, and bills is one thing — but what about those unexpected or irregular costs that pop up during the year and are hard to manage?

That’s where sinking funds become powerful. They help you stay prepared, reduce financial stress, and take control of your money.

- Avoid Debt or Credit Card Use

Instead of swiping your credit card or borrowing money when a big expense comes up — like school fees, home repairs, or a trip — you already have the cash saved using the sinking fund method. No stress, no interest, and no loans.

- Reduce Budget Surprises

Reduce the risk of unexpected expenses ruining your budget because you’re already prepared for upcoming costs. Nothing feels like a surprise when you’ve planned.

- Build Financial Discipline

Saving for a specific goal with sinking funds builds patience and financial control. It trains you to stay focused, plan better, and avoid emotional or impulsive spending.

- Helps with Your Goals

Want to buy a new laptop, go on vacation, or give a wedding gift? Instead of delaying or breaking your budget, a sinking fund allows you to split that cost into small, manageable monthly savings.

Best Categories for Sinking Funds

Not sure where to start? Sinking funds can be created for any future expense you know is coming — especially the ones that aren’t part of your regular monthly budget.

Below are some of the most common and useful categories to consider. You don’t need to use all of them — just pick the ones that match your life and goals.

Most Useful Sinking Fund Categories

- Car Maintenance

- Oil changes, new tires, or unexpected repairs — cars always need something.

- Medical Expenses

- Doctor visits, dental work, eye care, or medicine that isn’t covered by insurance.

- Travel or Vacation

- Family trips, weekend getaways, or annual vacations — planning makes it stress-free.

- Gifts & Holidays

- Birthdays, Eid, weddings, Christmas, New Year — events that come every year.

- Home Repairs

- Plumbing, painting, fixing appliances — even if you rent, things break.

- Annual Subscriptions

- Services like Netflix, Canva, Amazon Prime, or domain hosting you pay once a year.

- School Fees or Supplies

- Especially helpful for parents and students before each new semester.

- Insurance Premiums

- Health, life, or car insurance that is paid every 6 or 12 months.

- Technology or Gadgets

- Planning to buy a new phone, tablet, or laptop? Start saving now.

- Clothing or Shopping

- Seasonal wardrobes, shoes, uniforms, or kids’ growth spurts.

Table: Sinking Fund Categories and Examples

| Category | Examples | Why It’s Useful |

| Car Maintenance | Oil change, tires, repairs | Cars often need surprise work |

| Medical Expenses | Checkups, dental, eye care | Helps avoid financial pressure from illness |

| Travel or Vacation | Family trips, weekend plans | Enjoy travel without credit card debt |

| Gifts & Holidays | Birthdays, holidays, special events | These costs repeat every year — plan ahead |

| Home Repairs | AC repair, water leaks, new furniture | Keeps your home comfortable and safe |

| Subscriptions | Netflix, hosting, Amazon Prime | Annual costs are easy to forget |

| School/Education | Fees, books, uniforms | For students or kids, these always come back |

| Insurance Premiums | Auto, health, life | Avoid lump-sum payments |

| Tech & Gadgets | Phone, laptop, accessories | Plan big purchases the smart way |

| Clothing/Shopping | New clothes, shoes, seasonal sales | Avoid over-spending during sales or events |

Tip: Start with 2–3 categories. As you build confidence, add more. Use labels, envelopes, apps, or bank accounts — whatever works best for you.

How to Start Sinking Funds (Step-by-Step Guide)

Starting that fund is easy, even if you’re a beginner. You don’t need fancy tools or a big income — just a clear goal and a bit of planning.

Here’s how to set one up in 5 simple steps:

Step 1: Identify Your Upcoming Expenses

Think about what big or irregular costs are coming up in the next few months or year. Ask yourself:

- Is your car due for service?

- Do you have a birthday or event coming?

- Is there a subscription or bill you pay once a year?

Write down each expense, the estimated cost, and when you’ll need it.

Step 2: Set a Target Amount

Once you know what you’re saving for, figure out how much you’ll need in total.

Example:

You want to save $600 for a vacation in 6 months.

That’s your goal amount.

Step 3: Break It Down Monthly

Now divide the total amount by the number of months left before the expense.

Formula:

Goal Amount ÷ Months = Monthly Saving

Example:

$600 ÷ 6 months = $100 per month

Step 4: Choose Where to Keep Your Fund

Decide how you’ll store the sinking fund:

- A separate bank account

- An envelope or cash pouch

- A budgeting app like YNAB, Goodbudget, or EveryDollar

- Google Sheets or Excel

Tip: Keep each sinking fund separate from your daily spending money.

Step 5: Add It to Your Monthly Budget

Include each sinking fund payment in your monthly budget, just like a bill.

This way, you never forget or skip it.

Bonus: Use a Tracker

Use a printable or digital Sinking Fund Tracker to:

- Monitor progress

- Stay motivated

- See how close you are to your goal

Would you like a free printable tracker or a Google Sheet template suggestion?

Sinking Fund Example (Real Scenario)

Let’s walk through a real-life example to see how a sinking fund works in action.

Scenario:

Sarah wants to go on a family vacation 6 months from now.

She estimates the trip will cost her $1,200.

Instead of waiting until the last minute or using her credit card, she decides to create a sinking fund.

Here’s How She Does It:

| Step | Details |

| Total trip cost | $1,200 |

| Time to save | 6 months |

| Monthly saving goal | $1,200 ÷ 6 = $200/month |

| Where she keeps her savings | A separate savings account labeled “Trip” |

| Budget category name | Vacation Fund |

Each month, Sarah sets aside $200 into her vacation sinking fund.

By the time her trip arrives, she has the full $1,200 saved — no stress, no debt, no surprise.

Why This Works:

- She planned ahead.

- She broke the cost into small parts.

- She stayed consistent each month.

That’s the power of a sinking fund — turning big expenses into manageable monthly goals.

Sinking Fund vs Emergency Fund vs Savings

Many people confuse sinking funds, emergency funds, and general savings — but each has a different purpose in your financial plan.

Let’s break it down so it’s easy to understand.

Sinking Fund

- Purpose: To save for specific, planned future expenses

- Example: Car maintenance, vacations, school fees

- Planned? Yes

- Access: Used only for its dedicated goal

You know the expense is coming — you’re just preparing early.

Emergency Fund

- Purpose: To cover unexpected, urgent, or surprise expenses

- Example: Job loss, medical emergency, car accident

- Planned? No — it’s for the unknown

- Access: Only during emergencies

It’s your financial safety net when life throws surprises at you.

General Savings

- Purpose: For long-term goals or building overall wealth

- Example: Buying a house, starting a business, investing

- Planned? Yes, but not always time-specific

- Access: Often held longer, sometimes invested

This is more about growing your future — not handling short-term costs.

Comparison Table

| Fund Type | Purpose | Planned? | Used For |

| Sinking Fund | Known, specific upcoming expenses | Yes | Vacation, repairs, school fees |

| Emergency Fund | Unexpected, urgent expenses | No | Job loss, health crisis, car accident |

| General Savings | Flexible or long-term financial goals | Yes | House down payment, investment, assets |

Quick Tip:

You can have all three working together:

- Emergency Fund = Your safety net

- Sinking Funds = Your expense planner

- Savings = Your future builder

Where to Keep Your Sinking Funds

Once you’ve decided to start using sinking funds, the next important step is deciding where to actually store the money.

The key is to keep your fund money separate from your regular spending money, so it doesn’t get mixed up or spent by mistake. Below are the most practical and beginner-friendly options.

1. Separate Bank Accounts

You can create one or multiple savings accounts just for your funds. Many banks now allow you to create separate sub-accounts or labeled goals within your main account.

This way, your money is safe, easy to track, and automatically saved without mixing it with your main balance. For example, you can have one account for travel, another for insurance, and another for gifts.

This method is best if you prefer digital banking and want everything organized in one place.

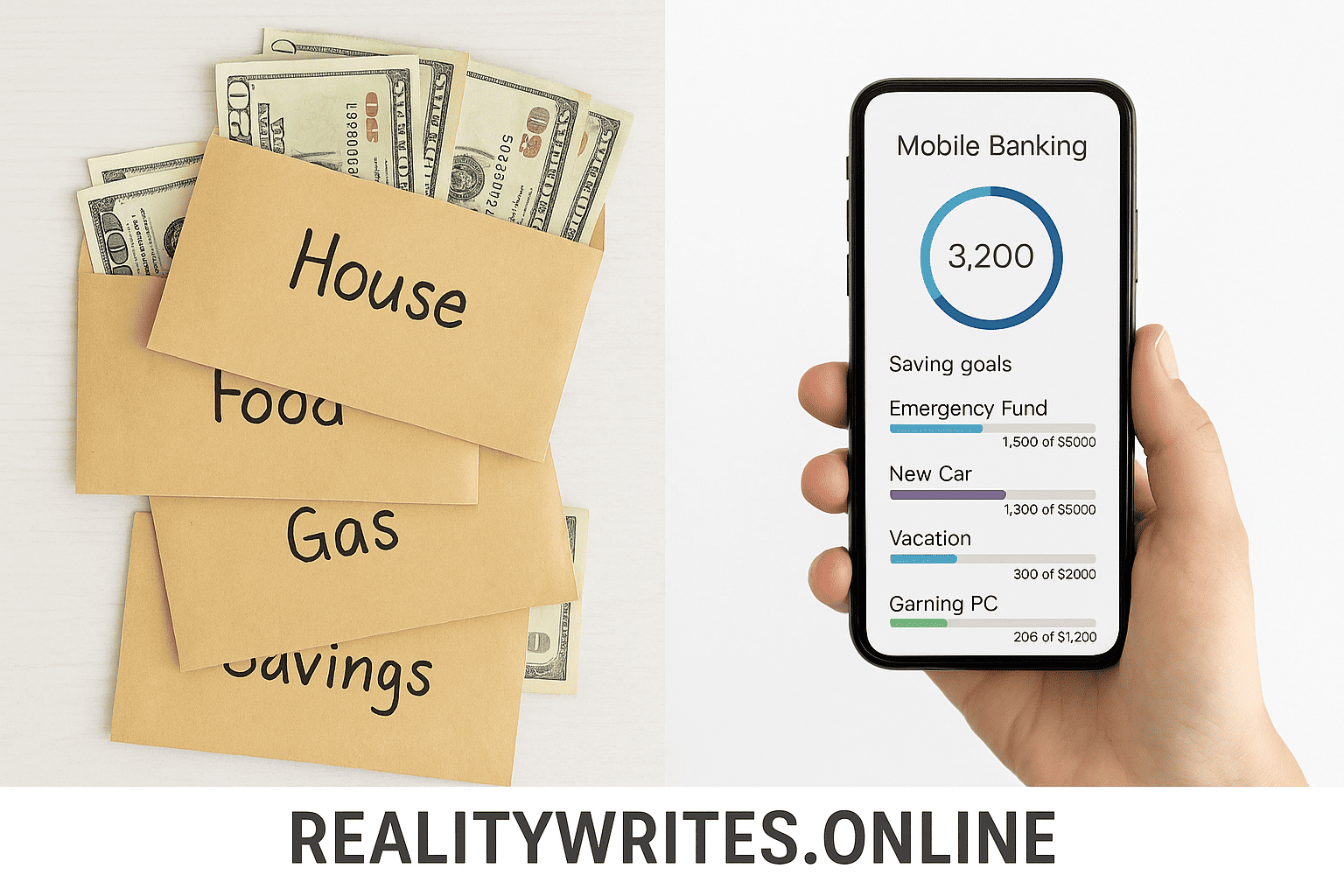

2. Cash Envelopes

If you like handling cash, this is one of the oldest and simplest methods. You label an envelope for each goal — like “Vacation” or “Car Repair” — and add money into them each month.

It’s a very hands-on way to control spending, but it’s better suited for smaller goals. Be careful with security — avoid storing large amounts of cash at home

3. Budgeting Apps

Apps like YNAB (You Need a Budget), Goodbudget, and EveryDollar allow you to set up digital categories and track each sinking fund without needing separate bank accounts.

This is ideal if you want to track everything in one place using your phone or computer, and you want more visual control over your money flow.

4. Google Sheets or Excel

You can create your own simple tracker using a spreadsheet. Just list out each sinking fund category, set your goal amounts, and record your monthly savings manually.

This method gives you full control, no app limits, and is free to use. It works well if you already use spreadsheets for your budget.

5. Notebooks or Budget Journals

If you prefer pen and paper, use a notebook or bullet journal. Create separate sections for each fund and update them each month as you save.

This method works great if you enjoy physical planning and want to stay away from screens.

No matter which method you choose, the most important thing is to keep your sinking fund organized and separate. That way, when the expense arrives, you won’t touch your emergency savings or rely on credit — you’ll already be prepared.

Tools to Manage Sinking Funds

Managing your funds doesn’t have to be complicated. Whether you prefer apps, spreadsheets, or pen and paper, there are plenty of tools to help you stay on track, stay organized, and reach your savings goals without stress.

Here are some of the most useful tools you can start with:

1. Budgeting Apps

Some apps are designed to help you divide your income into categories, including sinking funds. These are great if you like using your phone or computer for budgeting.

You Need a Budget (YNAB):

A powerful app built around zero-based budgeting. You can create as many categories as you want, track your goals, and move money between funds when needed.

EveryDollar:

Simple and beginner-friendly. It follows the zero-based method and helps you assign every dollar a job, including sinking funds.

Goodbudget:

Follows the envelope method but in digital form. You can create separate envelopes for each sinking fund and track spending easily.

Zeta (for couples):

Ideal if you’re budgeting with a partner. It helps manage shared and individual funds, including sinking fund categories.

PocketGuard:

Helps you track your spending, see what’s left “in your pocket,” and manage bills and goals — including savings funds.

2. Spreadsheets (Google Sheets or Excel)

If you want full control or prefer a DIY approach, spreadsheets are a great option. You can:

- Create a row for each fund category

- Add target amounts and track your monthly progress

- Color-code your updates and make it visual

This method works well for people who want a free tool and don’t mind updating manually.

3. Printable Trackers

There are free and paid printable trackers you can download, especially if you enjoy physical planning. You simply write down each fund, goal amount, and monthly contributions.

This method works well if you like visual progress and want something you can hang on a board or keep in a binder.

4. Notebooks or Budget Journals

If you’re not into apps or spreadsheets, a regular notebook can still do the job. Divide a few pages for each fund, set your goals, and track your savings manually. It’s simple, distraction-free, and works well if you enjoy budgeting as a daily or weekly habit.

Final Thought on Tools

The best tool is the one you’ll actually use. Whether it’s a high-tech app or a basic notebook, what matters is that your system keeps your funds separate, clear, and consistent.

Absolutely! Here’s a conclusion with a strong CTA (call-to-action), written in your voice — simple, human, and clear:

Conclusion

Sinking funds are one of the smartest ways to manage your money with purpose. Instead of getting surprised by large expenses or falling into debt, you plan ahead and stay in control. Whether it’s a vacation, car repair, school fee, or a special event — you’re ready when the time comes.

The best part? You don’t need a big income or complex tools to start. Just pick a goal, break it down, and save a little every month. That’s it. Over time, this habit makes a big difference in your financial life.

When you organize your income this way, you’re not just saving — you’re building confidence, reducing stress, and creating better money habits.

Ready to Get Started?

Now it’s your turn to take control of your finances.

- Choose 2 or 3 fund categories that matter to you

- Use a simple tracker, app, or spreadsheet

- Start saving small — and stay consistent

Want help staying on track?

- Download our free Sinking Fund Tracker

- Read our full guide on How to Build an Emergency Fund

- Explore more smart tips in our Monthly Budget Planner

Still have questions? Leave a comment or reach out — I’m here to help you build better money habits, one step at a time.

What is Sinking Funds?

A Sinking find is a way to save a portion of your income for specific upcoming future needs — helping you cover those expenses when the time comes.

How is a sinking fund different from an emergency fund?

A sinking fund is for planned expenses (like car repairs, school fees, or vacations). An emergency fund is for unexpected costs (like medical emergencies or job loss). One is expected — the other is not.

Do I need both a sinking fund and an emergency fund?

Yes. This fund helps you prepare for known future expenses. An emergency fund protects you from financial surprises. Both work together to keep your finances strong.

How many sinking funds should I have?

Start with 2–3 categories that fit your life, like travel, gifts, or car maintenance. You can add more once you’re comfortable with the habit.

Where should I keep my sinking fund money?

You can use labeled envelopes (for cash), a separate savings account, a budgeting app, or a spreadsheet — anything that keeps the money organized and separate from your daily spending.