Monthly Budget Planner: How to Create Monthly Budget

A monthly budget is a plan that tracks your income and spending each month. It helps you meet financial goals, build savings, and avoid overspending. In fact, budgeting can put you on stronger financial footing by categorizing and tracking expenses to pay bills on time and save for big expenses like a car or home. For example, many financial organizations offer a free “monthly budget calculator” that promises a clear view of your monthly finances so you can adjust your spending and make the most of your income. Using a monthly budget planner – whether a simple spreadsheet or an app – gives you that clear view and makes your money work smarter.

Table of Contents

Why You Need a Monthly Budget

A monthly budget offers many benefits: it shows exactly where your money goes, helps you save, and reduces stress about finances. For example, budgeting helps you:

- Pay bills on time: Tracking due dates and amounts ensures you meet obligations and avoid late fees.

- Save for goals: By setting a target (vacation, new car, emergency fund) and earmarking money each month, you’ll steadily reach your milestones.

- Manage spending: Seeing your expenses laid out makes it easier to spot wasteful habits. Modern budget tools can automatically record and categorize spending, giving you a clear picture of your habits.

- Reduce financial stress: Organizing income, expenses, and goals in one place takes the guesswork out of money management. You’ll feel more in control knowing exactly how much you earn, spend, and save.

In short, a good budget shows you where every dollar is going, freeing you to make smarter financial decisions. Budgeting not only helps build savings and an emergency fund, but also minimize the temptation to overspend. With a clear monthly plan, you won’t be caught off-guard by surprise expenses.

How to Create a Monthly Budget

Follow these steps to set up your budget. Write down your income and expenses, allocate amounts, and then track your spending.

- Calculate your income: List all sources of take-home pay (net salary, side gigs, etc.) for the month. This is the total money you have to work with.

- List your expenses: Write down fixed costs (rent/mortgage, insurance, utilities, car payments) and variable costs (groceries, gas, entertainment). Don’t forget irregular costs (annual subscriptions or quarterly insurance).

- Subtract expenses from income: Add up all your expenses and subtract from your income. A zero or positive balance means your budget is balanced. If you’re negative, you’ll need to trim spending.

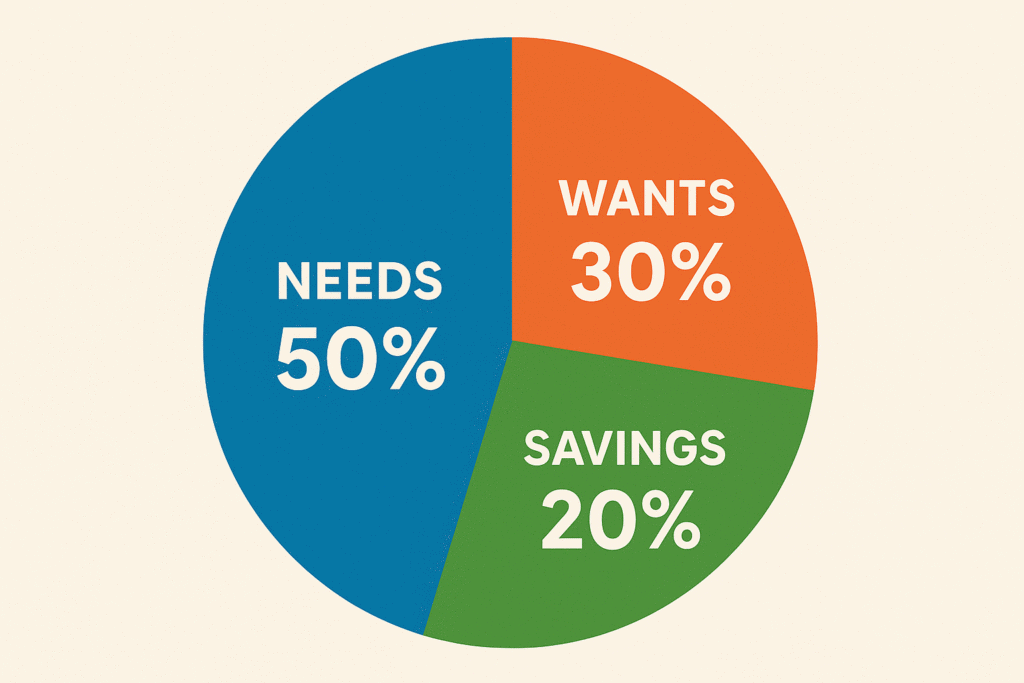

- Allocate your budget: Decide how much goes to each category. Many people use the 50/30/20 rule as a guide: roughly 50% of income for needs (essentials like housing and food), 30% for wants (dining out, hobbies), and 20% for savings/debt. Adjust the percentages to fit your situation (e.g. a high cost of living might call for a 60/30/10 split).

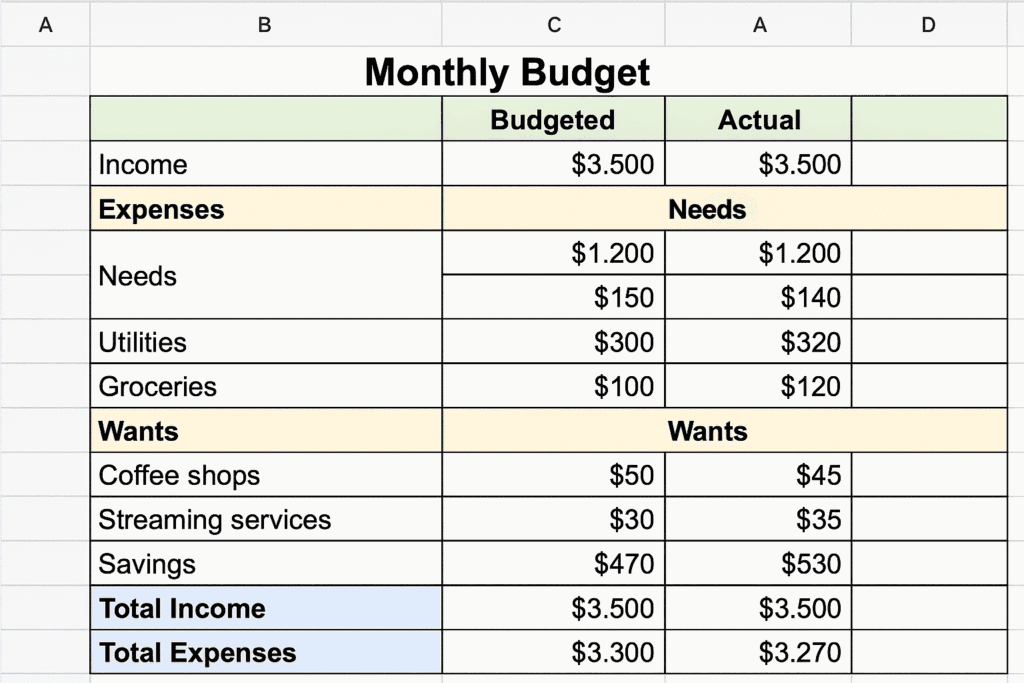

- Use tools to calculate: Consider using a monthly budget calculator or template to do the math for you. For instance, budget calculators prompt you to enter income and expenses and then show your total surplus or deficit. Microsoft Excel and Google Sheets both have free budget spreadsheet templates you can customize. Even downloadable budget spreadsheets can compare your entries to the 50/30/20 rule automatically.

- Track spending and adjust: As the month goes on, record your actual spending. Compare it to your budget plan. If you overspend in one category, cut back in another. Over time, tweak your budget categories so they fit your life.

For quick setup, download free templates or apps. Microsoft and Google Sheets have downloadable or cloud-based monthly budget templates. These can save you time and reduce errors.

Popular Budgeting Methods

There are several ways to structure a budget. Here are the most common systems:

- 50/30/20 Rule: Split your income into fixed categories. 50% goes to needs (rent, utilities, groceries), 30% to wants (entertainment, dining out), and 20% to savings/debt. This simple rule keeps things balanced and is a good starting point for most people.

- Envelope (Cash) System: Set a cash limit for each spending category. You put that cash in labeled envelopes or cash jars, and once it’s gone you stop spending in that category. This tactile method helps curb impulse buys.

- Pay Yourself First: Prioritize saving. Decide on a monthly savings amount (for retirement, emergency fund, etc.) and move that money out first. Use whatever remains to cover bills and daily expenses. This reverse approach makes your financial goals non-negotiable, so you build savings without feeling the pinch on living expenses.

- Zero-Based Budget: Give every dollar a job. Track your income, assign each dollar to a specific expense or savings goal, and ensure your income minus expenses equals zero at the end of the month. This detailed plan means no money is unaccounted for. Apps like You Need A Budget (YNAB) and EveryDollar are designed for this method.

Each method has its strengths. The key is choosing one you will stick with. The best budget is the one that works for you and fits your habits and goals.

| Method | How it Works | Best For |

|---|---|---|

| 50/30/20 Rule | Splits income into 50% needs, 30% wants, and 20% savings/debt. | General budgeting, beginners |

| Envelope System | Cash-based: divide money into envelopes by category. | Controlling impulse spending |

| Pay Yourself First | Save a set amount first; use the remainder for bills and spending. | Savers and goal-oriented planners |

| Zero-Based Budget | Assign every dollar of income a purpose until none is left. | Meticulous budgeters |

This table shows the key idea of each method and who it suits best. You can also blend techniques – for example, use a 50/30/20 split while handling personal spending with cash envelopes. The important part is having a plan that fits your lifestyle.

Budgeting Tools: Spreadsheets, Apps, and Calculators

Once you know your method, use the right tools to make budgeting easy:

- Excel & Google Sheets: Both offer free budget templates. Microsoft’s site has downloadable Excel spreadsheets for monthly budgets and special events. Google Sheets has its own gallery of templates, including a “Monthly Budget” sheet that auto-calculates totals. These templates let you see all your months side by side, which is great if your income or bills fluctuate.

- Online Budget Calculators: Budget calculators prompt you to enter income and category expenses, then instantly show you whether you have a surplus or shortfall. They often include tips on adjusting your budget. Using a calculator is a quick way to check your math and experiment with different expense levels.

- Budgeting Apps: There are many personal finance apps. Apps like Mint, PocketGuard or others let you link bank accounts so transactions automatically sync and categorize. Paid apps like You Need A Budget (YNAB) or EveryDollar specialize in zero-based budgeting and help you allocate every dollar in advance. These tools often include mobile alerts and visual charts so you stay on track.

- Budget Spreadsheets: Some websites offer a free downloadable budget spreadsheet. You input your monthly income and expenses, and it compares your plan to the ideal 50/30/20 breakdown. It even prompts for less obvious expenses (like insurance and travel) so nothing slips through the cracks.

- Traditional Worksheets: For a no-tech option, printable budget worksheet PDFs are available to fill in by hand. It’s an easy starting point if spreadsheets feel intimidating.

Choose tools that match your style. If you prefer hands-on organizing, spreadsheets might be best. If you want automation, apps can save time. Remember, tools are most effective when used regularly.

Monthly Budget Cheat Sheet

Use this quick-reference table as your budgeting cheat sheet. It lists each category with tips on what to do:

| Category | Cheat Sheet Tip |

| Monthly Income | Add up all your take-home (post-tax) income. Include wages, side income, etc. |

| Needs (Essentials) | List must-pay bills (rent, groceries, utilities, insurance). Aim to keep these ≲50% of income. |

| Wants (Discretionary) | Budget fun spending (dining out, shopping, entertainment). Try not to exceed ~30% of income. |

| Savings & Debt | Save or pay extra on debt with at least 20% of income. Treat this as a non-negotiable “bill.” |

| Track & Adjust | Check your spending each week or month. If you go over in one category, cut back in another. Review and tweak your budget regularly. |

Each line above summarizes a key step or rule. Keep this table handy as you fill in your budget planner or use a budget calculator.

Final Thoughts

Creating a monthly budget planner or using a monthly budget calculator is the first step to financial peace of mind. By following the steps above and picking a budgeting method that fits you, you turn vague goals (“save more”) into an actionable plan. Remember that discipline matters more than method. Use the budgeting methods comparison and cheat sheet above as guides, and don’t be afraid to adjust as your situation changes. With the right tools, a clear plan, and regular tracking, you’ll gain confidence in your finances and watch your savings grow.

FAQ

How do I start a monthly budget if I’ve never done one before?

Start by listing your income, then your expenses. Use a simple spreadsheet or app like Mint or YNAB. Categorize your spending into needs, wants, and savings. Track daily, adjust monthly.

What is the best monthly budget planner for beginners?

Google Sheets or Microsoft Excel templates are great for beginners. Apps like Goodbudget (envelope style) or Mint (auto-syncing) are also beginner-friendly and free.

How much of my income should go to savings each month?

A good starting point is 20% of your monthly income, following the 50/30/20 rule. If that’s too high, save what you can consistently — even 5–10% adds up over time.

What’s the 50/30/20 budgeting rule, and how does it work?

It’s a simple budget method: spend 50% of your income on needs, 30% on wants, and save 20%. It’s flexible and ideal for people new to budgeting.

Is there a free monthly budget calculator I can use online?

Yes. Sites like NerdWallet, Quicken, and Mint offer free monthly budget calculators that auto-calculate based on your income and expenses.

Should I use an app or a spreadsheet for budgeting?

Use what you’re most comfortable with. Spreadsheets offer more control; apps like YNAB, Mint, or PocketGuard automate tracking and can save time.