Introduction: Why You Need an Emergency Fund Now More Than Ever

Ever worried how to set up an emergency fund? Picture life’s curveballs: a flat tire on the way to work, a surprise vet bill, or a sudden job loss. These moments can derail your budget in a flash. That’s why an emergency fund – a stash of cash set aside for unexpected costs – is your financial seatbelt. With a solid emergency fund, you’ll avoid high-interest debt and gain peace of mind. In fact, experts recommend aiming for about 3–6 months of living expenses in savings. If that sounds daunting, remember: even starting small makes a big difference. Just $3 per day, for instance, adds up to roughly $1,000 a year – enough to cover several months of basic expenses.

Table of Contents

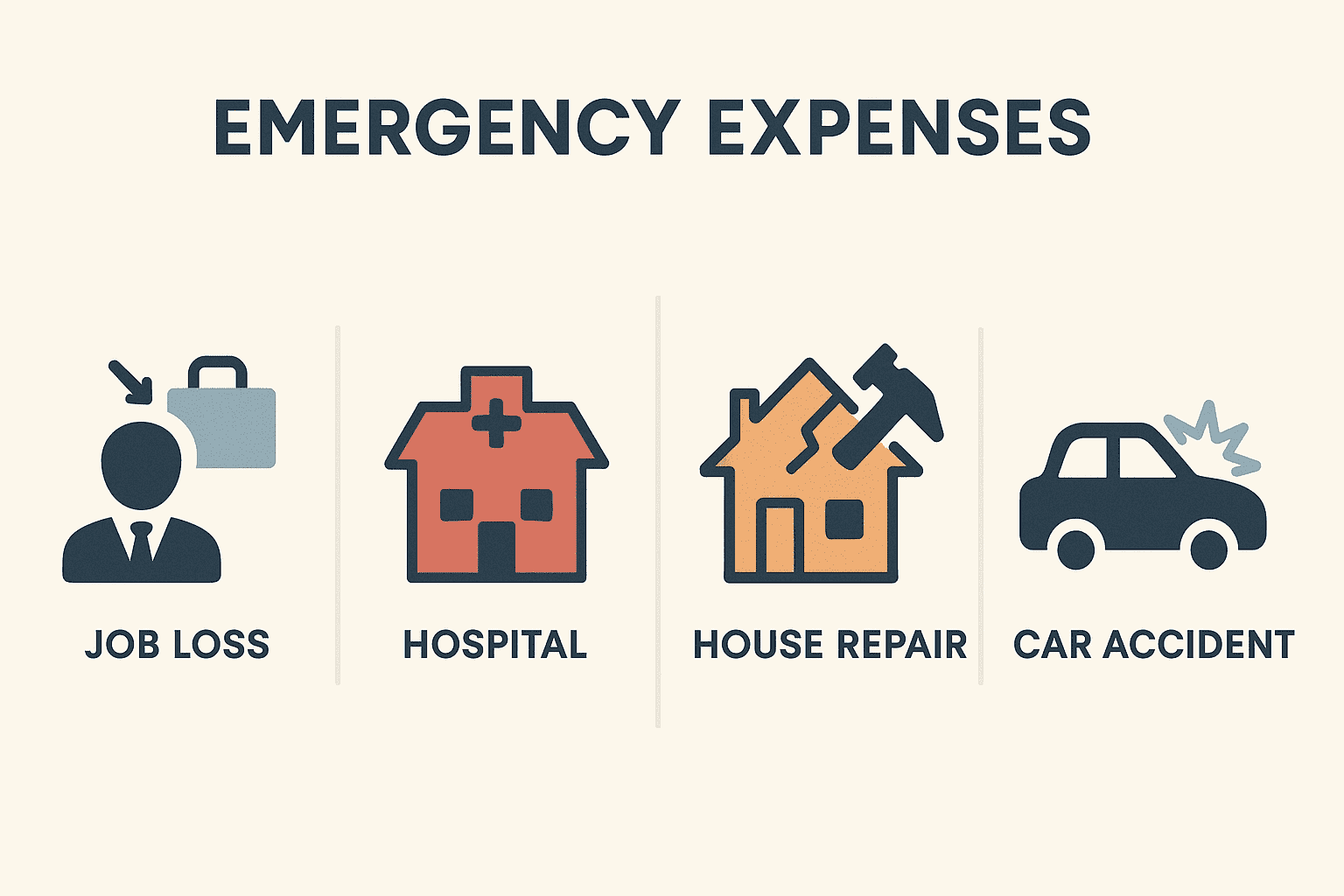

What Is an Emergency Fund (and Why It’s Different from Regular Savings)

An emergency fund is only for truly unexpected needs. Car repairs, urgent vet visits, sudden medical problems or a job loss – these are exactly the situations it’s meant for. This is different from other savings goals like vacations, weddings, or new gadgets, which are planned and optional. By keeping your emergency money separate (for example, in its own savings account), you’ll resist the temptation to dip into it for everyday wants. This dedicated cushion tides you over when outflows temporarily exceed income, without resorting to credit cards or loans.

Emergency funds also serve a psychological purpose. They provide a sense of control and reduce stress during crises. According to a study by the Federal Reserve, 37% of Americans would struggle to cover a $400 emergency with cash. That means more than 1 in 3 people are just one unexpected expense away from financial distress. Your emergency fund is your first line of defense against life’s unpredictability.

Step-by-Step Guide to Building Your Fund

1. Set a Realistic Target and Open a Separate Account

Decide how much you want to save. Financial pros often suggest at least 3 months of expenses, ideally 6 or more. But start with whatever feels doable – even $50 or one week’s worth of pay. Open a dedicated savings account with no or low fees, easy withdrawals, and decent interest.

Use this simple formula to estimate your goal: Monthly Expenses × 3 or 6 = Emergency Fund Goal

If you spend $1,500/month, aim for at least $4,500.

2. Track Your Money and Budget

List your income and all expenses to find spare cash. Use budgeting tools like the 50/30/20 rule to identify where your money goes:

- 50% Needs (Rent, Bills, Groceries)

- 30% Wants (Dining Out, Subscriptions)

- 20% Savings/Debt Repayment

Even simple apps or spreadsheets can help redirect extra cash into savings. (See our guide [How to Create a Monthly Budget] for more tips.)

3. Trim Unnecessary ExpensesNerdWallet

Cut out small costs. Brew coffee at home, pack lunch, skip that extra streaming subscription. These daily savings add up fast. For example:

- Coffee shop: $4/day → $100/month

- Takeout twice a week: $25/week → $100/month

- Subscriptions: $50/month

That’s potentially $250/month to redirect into your emergency fund.

4. Boost Your Income

If your income is tight, look for ways to increase it:

- Freelancing (writing, design, tutoring)

- Selling unused items online

- Gig work (Uber, Fiverr, TaskRabbit)

- Weekend part-time jobs

Redirect any side hustle income or unexpected windfalls directly into your emergency fund. This “extra” money won’t be missed if it’s saved immediately.

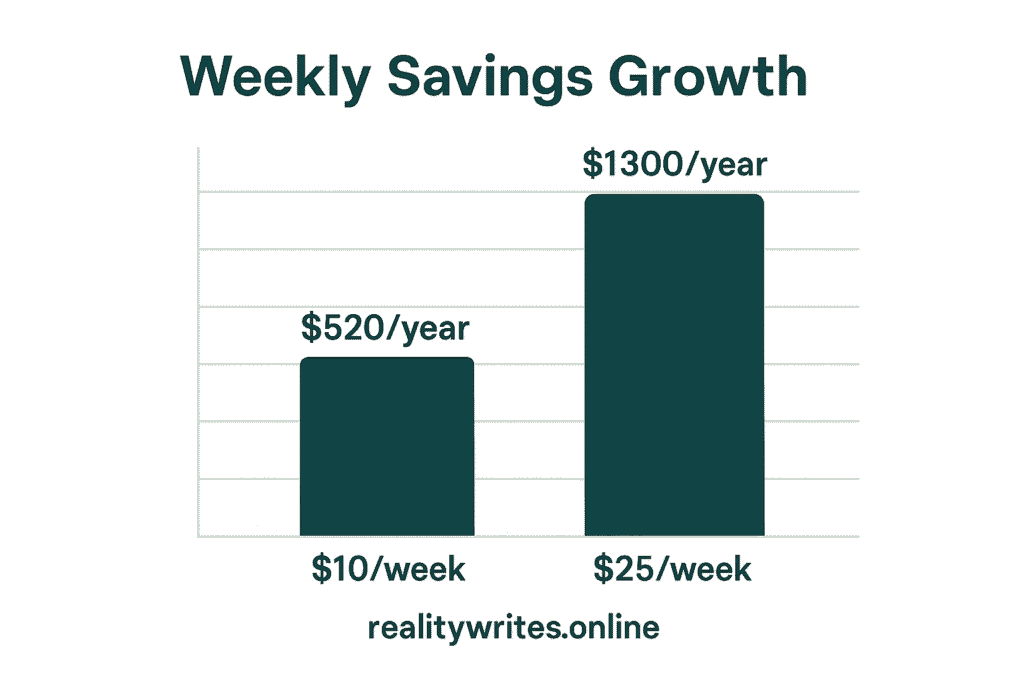

5. Automate It

Make saving effortless. Schedule automatic transfers to your emergency fund on payday. Even $20/week adds up to $1,040 a year. Use savings apps that round up purchases and deposit the difference, like:

- Chime

- Qapital

- Digit

These tools help build your savings without needing to think about it.

Handy Tools and Apps

Saving isn’t hard when the right tools are on your side. Consider:

- Qapital: Automates savings with customizable rules (e.g., save $1 every time you skip coffee).

- Chime: Rounds up your purchases and deposits change to savings.

- Digit: Uses AI to analyze your spending and automatically saves money you won’t miss.

- YNAB (You Need A Budget): Helps you assign every dollar a job so you can make room for savings.

- Personal Capital: Great for tracking both cash and investments.

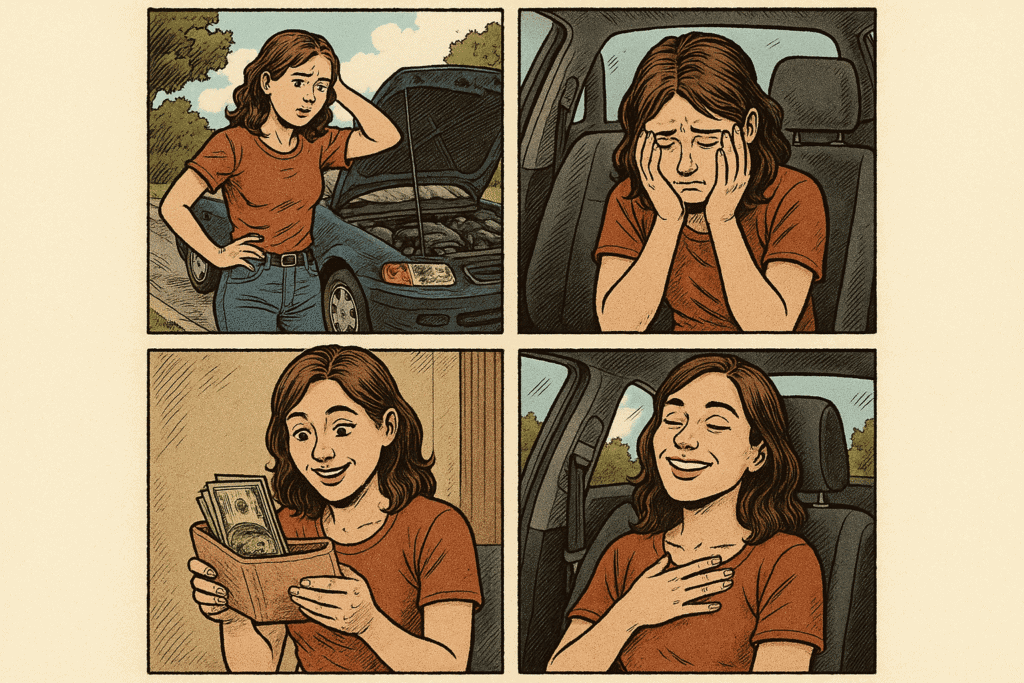

A Real-Life Success Story

Melanie, 22, started her job and soon faced a $2,000 car repair bill after an accident. Thankfully, she had $3,000 in a dedicated emergency fund. She used that cash and avoided debt. Instead of spiraling financially, her fund turned a crisis into a minor setback.

Similarly, Rahul, a freelance designer, saved $3/day consistently and built up $1,000 in a year. When a client failed to pay on time, he used the fund to cover rent and groceries – no stress, no loans.

These stories show that even small, consistent efforts protect you from big disasters.

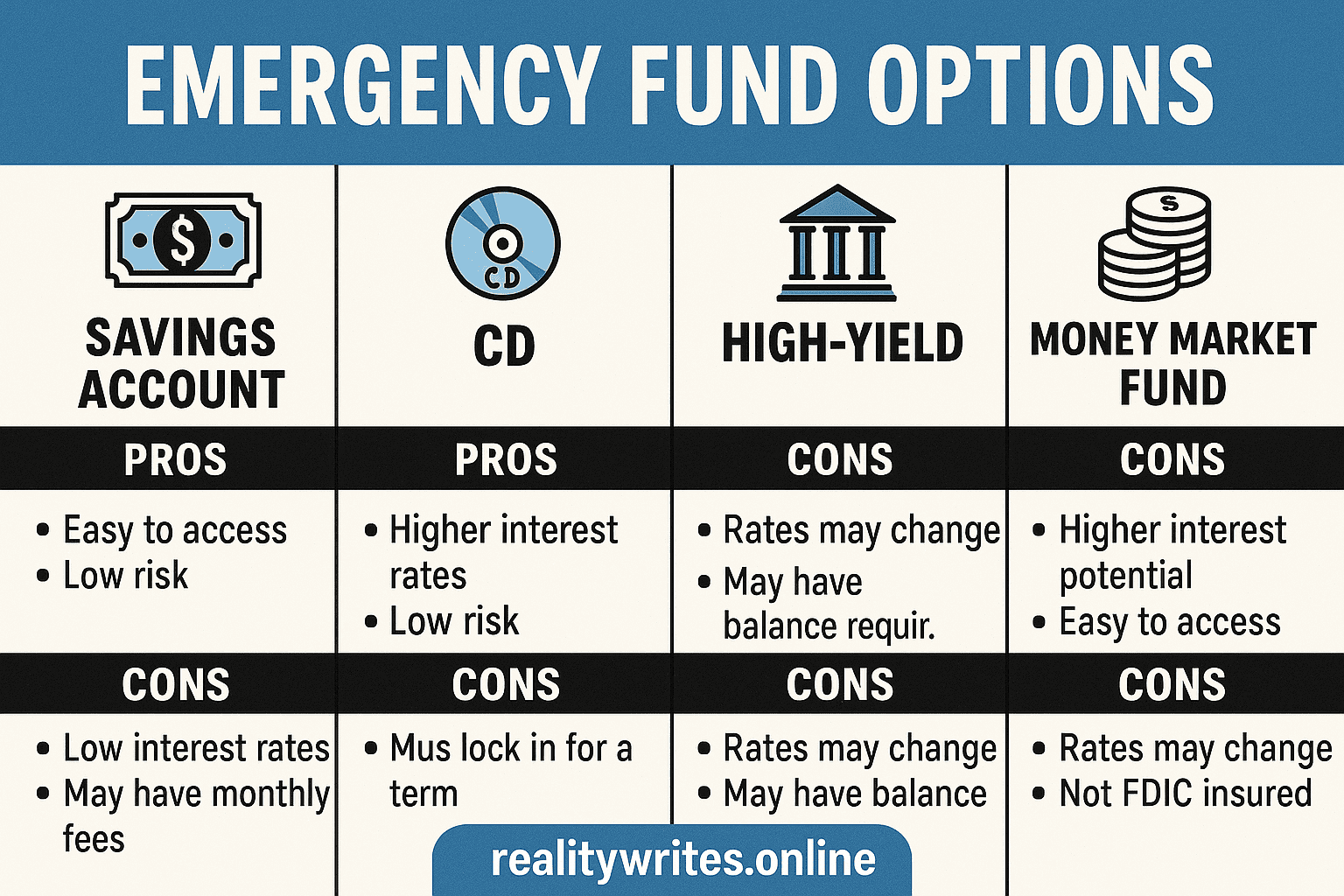

Best Places to Keep Your Emergency Money

| Account Type | Liquidity | Typical Interest Rate | Best For |

|---|---|---|---|

| Regular Savings Account | Very high (anytime) | ~0.5–1% | Easy access |

| High-Yield Savings Account | Very high (anytime) | ~3–4.5% | Better returns with liquidity |

| Short-Term CD | Moderate (fixed term) | ~4–5% | Safety with moderate access |

| Money Market Fund | High (1–2 days) | ~3–5% | Slightly better yield, still liquid |

Split your savings: keep 1 month’s expenses in a savings account, the rest in a high-yield or low-risk fund. Avoid locking all money away – you want access in a true emergency.

Common Mistakes to Avoid

- Mixing Emergency Fund with Regular Savings: Keep it separate

- Using High-Risk Investments: Stocks are not suitable for emergency funds

- Setting Unrealistic Goals: Start small and scale up

- Tapping Into It for Non-Essentials: Define “emergency” for yourself and stick to it

Final Thoughts & Call to Action

Building an emergency fund is like installing financial airbags. Start with what you can – even $10 is a win. Like Melanie and Rahul, you’ll thank yourself later.

Start saving $10 today. Your peace of mind is worth it.

FAQ

What exactly is an emergency fund?

An emergency fund is money you set aside for the unexpected — think job loss, medical bills, car repairs, or surprise home expenses. It’s not for vacations or new phones. It’s your financial backup plan when life throws you a curveball.

Why do I really need one?

Because life is unpredictable. One surprise expense — like a $1,000 car repair — can throw your entire budget off track. An emergency fund protects you from going into debt, borrowing from others, or losing sleep over money.

It gives you breathing room when you need it most.

How much should I save?

Start small and grow from there. A good emergency fund goes in stages:

First goal: $500 to $1,000

Next goal: 3 to 6 months of essential expenses

Bonus goal: 9+ months if your income is unstable (like freelancing)

If your monthly expenses are $2,000, aim for at least $6,000 over time. But don’t get overwhelmed — even $10 a week is progress.

Where should I keep my emergency fund?

The best place is somewhere safe and easy to access — but not too easy that you’re tempted to spend it.

Top choices:

High-yield savings account (best mix of access and interest)

Money market account (slightly higher returns)

Traditional savings account (simple and quick access)

Avoid using stock market or crypto for emergency funds. Those can go down right when you need the money.

When should I use my emergency fund?

Only when something is:

Unexpected (not your monthly bills)

Urgent (needs to be dealt with now)

Necessary (can’t be skipped or delayed)

Things like losing your job, a medical emergency, or a necessary car repair — yes. Upgrading your phone or going on a trip — not really.

Should I save money or pay off debt first?

Ideally, both. Start by building a small emergency fund — say, $1,000 — so you’re covered for minor surprises. Then focus on paying off high-interest debt. Once your debt is more manageable, come back to growing your savings.

You’re not choosing one over the other — you’re building a stable system.

What happens if I use my emergency fund?

Use it. That’s what it’s there for.

And then, make a plan to refill it as soon as you can. Even small automatic deposits — like $20 a week — will rebuild your cushion over time. Don’t feel guilty. Feel proud that you were prepared.

Can I build an emergency fund on a low income?

Yes — and you should. Even if you’re saving $5 a week, it adds up. The key is to:

Cut small expenses (like subscriptions or daily coffee)

Track your spending with a simple app or spreadsheet

Use any extra money (bonuses, refunds, side gigs) to build your fund

It’s not about how much you save — it’s that you start.

How do I stay consistent with saving?

Two words: automate it.

Set up an automatic transfer from your checking to savings every payday. Out of sight, out of mind — and that’s a good thing when building savings.

You can also use apps that round up your purchases and save the difference, or schedule weekly deposits to keep the habit going.