Introduction

Over 60% of people don’t track where their money goes each month—and most have no structured savings plan.

In a world where expenses pile up quickly, not having a clear budget often leads to financial stress and uncertainty.

Managing money can be difficult—especially when you’re trying to balance bills, enjoyment, saving, or paying off debt all at the same time. That’s where the 50/30/20 rule comes in. It’s a simple budgeting technique that helps divide your income into three parts: needs, wants, and savings or debt repayment.

Whether you’re a student, a freelancer, or a working professional, this rule helps you manage your finances without the hustle or confusion of complex budgeting tools.

Table of Contents

What Is the 50/30/20 Rule?

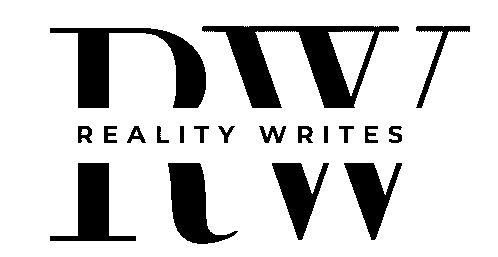

Let’s understand the 50/30/20 rule in simple terms. It’s a helpful method to manage your income by dividing it into three categories:

- 50% for Needs – Spending on essentials like rent, bills, groceries, transportation, and healthcare.

- 30% for Wants – Spending on things you enjoy, such as shopping, eating out, entertainment, or subscriptions.

- 20% for Savings or Debt – Putting money aside for future goals, emergency funds, or repaying loans and credit card debt.

Example:

Let’s take the example of Mr. John, who earns $5,000 per month. He followed the 50/30/20 method to manage his budget:

- 50% ($2,500) went to monthly bills like rent, groceries, and utilities.

- 30% ($1,500) was spent on entertainment and weekend enjoyment like dining out or going to the movies.

- 20% ($1,000) was saved for a future goal — in his case, buying a car

You can also try this with your income using a free 50/30/20 calculator to see how your budget should be divided.

History of the 50/30/20 Budget Rule

The 50/30/20 budgeting rule was popularized by U.S. Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their 2005 book,

“All Your Worth: The Ultimate Lifetime Money Plan.”

Their goal was to simplify personal budgeting and make financial planning more accessible for everyone—especially middle-class Americans.

What They Proposed:

They broke budgeting into three basic categories:

- 50% for life’s essentials (needs)

- 30% for personal enjoyment (wants)

- 20% for future security (savings and debt repayment)

This rule gained popularity because of its simplicity, flexibility, and focus on financial balance, making it ideal for both budgeting beginners and experienced savers.

Why It Still Works Today:

Even in today’s world of apps and complex budgets, the 50/30/20 rule remains relevant because:

- It encourages mindful spending

- It prioritizes saving and debt payoff

- It’s easy to apply across any income level

Let’s Understand: Needs, Wants, Savings, and Debt

To follow this rule properly, it’s important to understand each term clearly:

- Needs are the things you must have to live — food, housing, utility bills, transportation, and basic healthcare. Without these, you can’t survive.

- Wants are things you like to have, but you can live without them — like going out to eat, buying new clothes, or streaming your favorite shows.

- Savings mean setting aside money to use in the future, like building an emergency fund, buying an asset, or planning for retirement.

- Debt means borrowing money from someone or a bank and paying it back later. This includes loans, credit cards, or even borrowed items that must be returned.

How to Apply the 50/30/20 Rule to Your Own Income

To use this rule, start by calculating your total monthly income. Then divide it like this:

- 50% for your needs

- 30% for your wants

- 20% for savings or paying off debt

Tip: If you’re not sure how to split your income manually, use our free calculator to get instant results. It helps you see exactly how much you should spend and save each month.

Try It Now: 50/30/20 Budget Calculator

Enter your monthly income below to see how to split it into needs, wants, and savings instantly.

50/30/20 Budget Calculator

Top 5 Budgeting Apps to Apply the 50/30/20 Rule

If you want to put the 50/30/20 rule into practice, the right budgeting app can make the process smoother, more accurate, and easier to manage over time. Below are five reliable apps that help you divide your income into needs, wants, and savings, while tracking your financial habits.

1. Goodbudget

Platform: iOS, Android, Web

Best for: Simple envelope-style budgeting

Goodbudget uses the classic envelope method to help you allocate money into different categories. You can set up envelopes based on the 50/30/20 framework and manually track expenses. It’s ideal for individuals or families looking for a straightforward budgeting experience.

2. YNAB (You Need A Budget)

Platform: iOS, Android, Web

Best for: Detailed, hands-on budgeting

YNAB is a powerful tool that gives every dollar a job. It’s especially useful if you want to strictly assign your income into the 50/30/20 categories and monitor your progress. The app also offers goal-setting tools and robust financial education resources.

3. EveryDollarPlatform: iOS, Android, Web

Best for: Zero-based budgeting with flexibility

EveryDollar allows you to build your budget from the ground up. You can customize your categories, track your income and expenses, and align your spending to the 50/30/20 rule. The interface is clean, and it’s beginner-friendly.

4. Monarch Money

Platform: iOS, Android, Web

Best for: All-in-one money management

Monarch Money offers comprehensive budgeting tools that allow users to create custom rules, such as the 50/30/20 split. It also helps track net worth, shared finances, and long-term financial goals. It’s particularly effective for couples or those managing multiple income sources.

5. Mint by Intuit

Platform: iOS, Android, Web

Best for: Automatic expense tracking and budgeting insights

Mint was one of the most popular personal finance apps before it merged with Credit Karma. While Mint is no longer active, Credit Karma now offers basic budgeting tools and continues to provide financial insights. It’s a solid option for tracking your income, bills, and credit health.

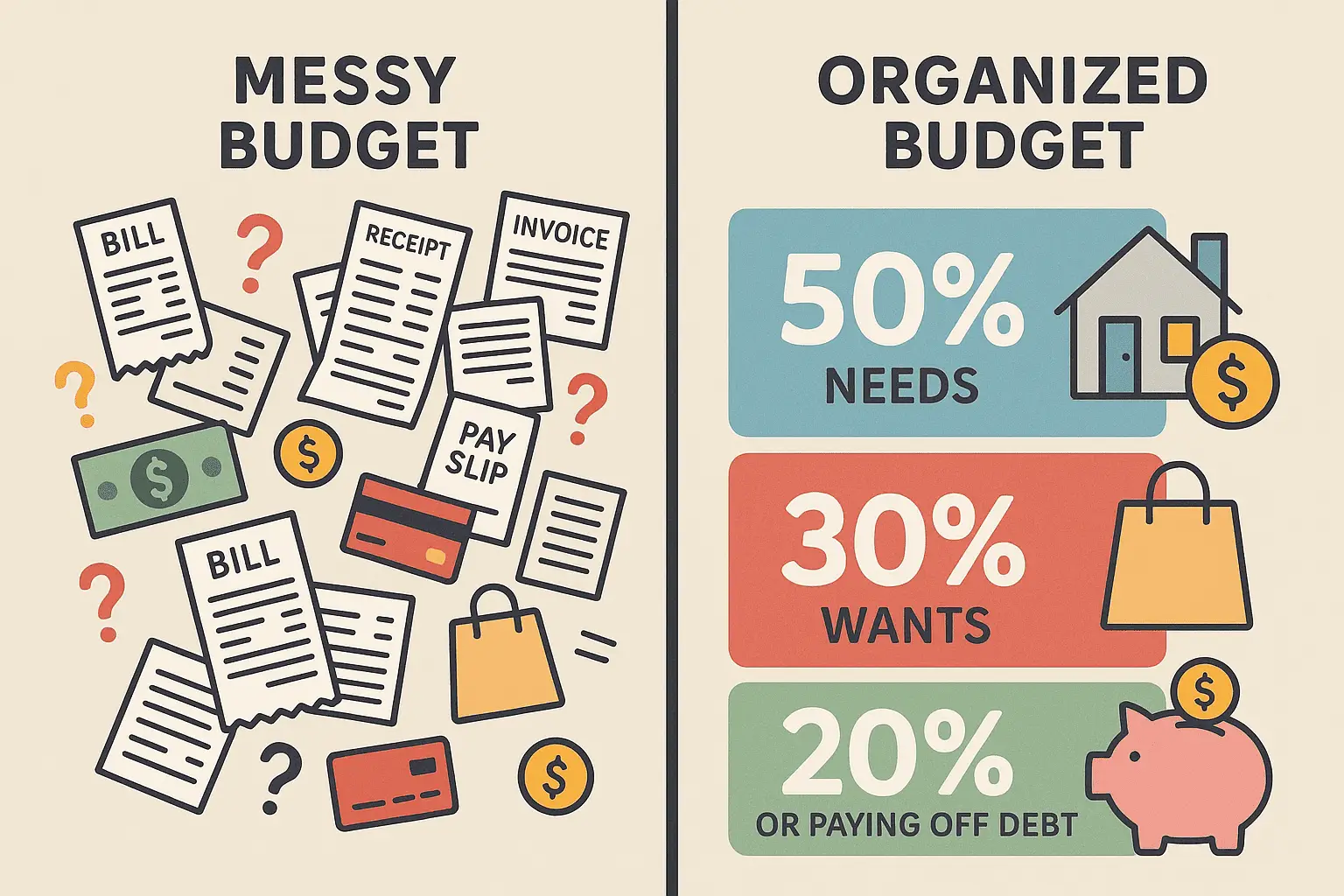

Unstructured Budget vs. the 50/30/20 Rule

An unstructured budget is like a blind budget where you don’t know what you’re spending or saving. This approach is risky because you’re unaware of your financial habits and may end up overspending or failing to save.

But in a self-structured budget like the 50/30/20 rule, you have a clear picture of where your money is going. It breaks your income into categories so you can track your spending on needs and wants, and also keep an eye on your savings or debt repayment. This gives you more financial control and peace of mind.

Comparison Table

| Feature | Unstructured Budget | 50/30/20 Budget Rule |

|---|---|---|

| Clarity | Low – You don’t know where your money is going | High – Spending is divided into clear categories |

| Control | Difficult to control or adjust finances | Easier to track, manage, and adjust spending |

| Spending Awareness | Often leads to overspending or emotional spending | Helps avoid unnecessary expenses |

| Savings Tracking | Unclear – savings may be inconsistent or ignored | Savings are a defined 20% of your income |

| Debt Management | Easy to ignore or miss payments | Debt repayment is prioritized within the 20% category |

| Stress Level | Higher – due to uncertainty about finances | Lower – more financial confidence and peace of mind |

| Suitability for Beginners | Not beginner-friendly | Very beginner-friendly and simple to follow |

| Planning Future Goals | Harder to plan for long-term goals like buying assets | Structured path to achieve financial goals |

Conclusion

The 50/30/20 rule is one of the easiest and most effective ways to manage your income. It gives you a balanced system to meet your basic needs, enjoy your lifestyle, and save for the future.

Instead of guessing where your money went each month, this rule gives you structure, control, and a clearer financial path.

Try our free calculator to start budgeting smarter today and take your first step toward financial success.

Let me know how you want to use this next!

Want More Practical Money Tips Like This?

Join our newsletter and get simple, actionable guides on budgeting, saving, and earning—delivered straight to your inbox.

No spam. No fluff. Just useful content you can apply.

Subscribe now to take control of your finances, one email at a time.

📩 [Subscribe to the Newsletter]

FAQ

Is the 50/30/20 rule suitable for low-income earners?

Yes. The rule can be adjusted based on your income. For lower earners, even allocating 10% to savings consistently builds good habits.

Can I modify the 50/30/20 rule to fit my goals?

Absolutely! You can change it to 60/20/20 or 40/30/30 if your lifestyle or debt situation requires more flexibility.

How often should I update my budget?

Monthly is ideal. Review your income and spending regularly and adjust the budget if needed.

What tools can I use to apply this rule?

Budgeting apps like u003ca href=u0022https://mint.intuit.com/u0022u003eMintu003c/au003e, u003ca href=u0022https://www.ynab.com/u0022u003eYNABu003c/au003e, or your own spreadsheet. Or use our free calculator right in this blog!

what is 50/30/20 rule?

Let’s understand the 50/30/20 rule in simple terms. It’s a helpful method to manage your income by dividing it into three categories:u003cbru003eu003cstrongu003e50% for Needsu003c/strongu003e – Spending on essentials like rent, bills, groceries, transportation, and healthcare.u003cbru003eu003cstrongu003e30% for Wantsu003c/strongu003e – Spending on things you enjoy, such as shopping, eating out, entertainment, or subscriptions.u003cbru003eu003cstrongu003e20% for Savings or Debtu003c/strongu003e – Putting money aside for future goals, emergency funds, or repaying loans and credit card debt.

Who created the 50/30/20 rule?

The rule was popularized by U.S. Senator u003cstrongu003eElizabeth Warrenu003c/strongu003e in her book u003cemu003eu0022All Your Worth: The Ultimate Lifetime Money Plan.u0022u003c/emu003e It was designed to make budgeting simple for everyone.

What if my needs take more than 50% of my income?

That’s okay. Many people in high-cost areas or with lower incomes spend more on needs. In that case, reduce your u0022wantsu0022 and try to preserve your 20% savings—even if it’s small. The goal is u003cstrongu003ebalanceu003c/strongu003e, not perfection.

Can I use this rule if my income is irregular (freelancers, gig workers)?

Yes! Use your u003cstrongu003eaverage monthly incomeu003c/strongu003e from the past 3–6 months. During higher-earning months, save more to cover low-income periods. It’s all about creating structure in uncertain cash flows.

Should I include taxes in the 50% needs portion?

No. The rule typically uses u003cstrongu003eafter-tax incomeu003c/strongu003e (your take-home pay). Taxes are deducted before you divide your income using the 50/30/20 method.

Is 20% savings realistic if I have a lot of debt?

If debt is your priority, use the 20% category mainly for u003cstrongu003edebt repaymentu003c/strongu003e first. Once your high-interest debt is gone, shift it toward u003cstrongu003esaving and investingu003c/strongu003e.