Financial Literacy: What It Is and Why It Matters

Financial literacy is the knowledge and skills needed to manage money wisely, from budgeting and saving to investing and debt management. In today’s world, money touches nearly every aspect of life – where we live, work, and even our well-being – yet many people lack the basic understanding to make smart financial decisions. In fact, surveys show that roughly half of U.S. adults perform poorly on basic financial questions. This gap – the importance of financial literacy – is huge: without it, even small setbacks (like an unexpected car repair) can spiral into debt or stress. As one banking expert puts it, “financial literacy is foundational to building financial independence,” because without knowing you cannot take action toward your goals.

In simple terms, being financially literate means understanding how money works – knowing how to earn it, spend it, save it, and grow it – and applying that knowledge day-to-day. For beginners, this journey starts with small steps: tracking income and expenses, sticking to a budget, and learning key concepts like interest and credit. The earlier you start, the better off you’ll be: research shows that people with higher financial literacy tend to save more, feel less financial stress, and make better long-term decisions. In other words, financial education isn’t just for experts – it’s the key to a more secure and confident financial future.

Table of Contents

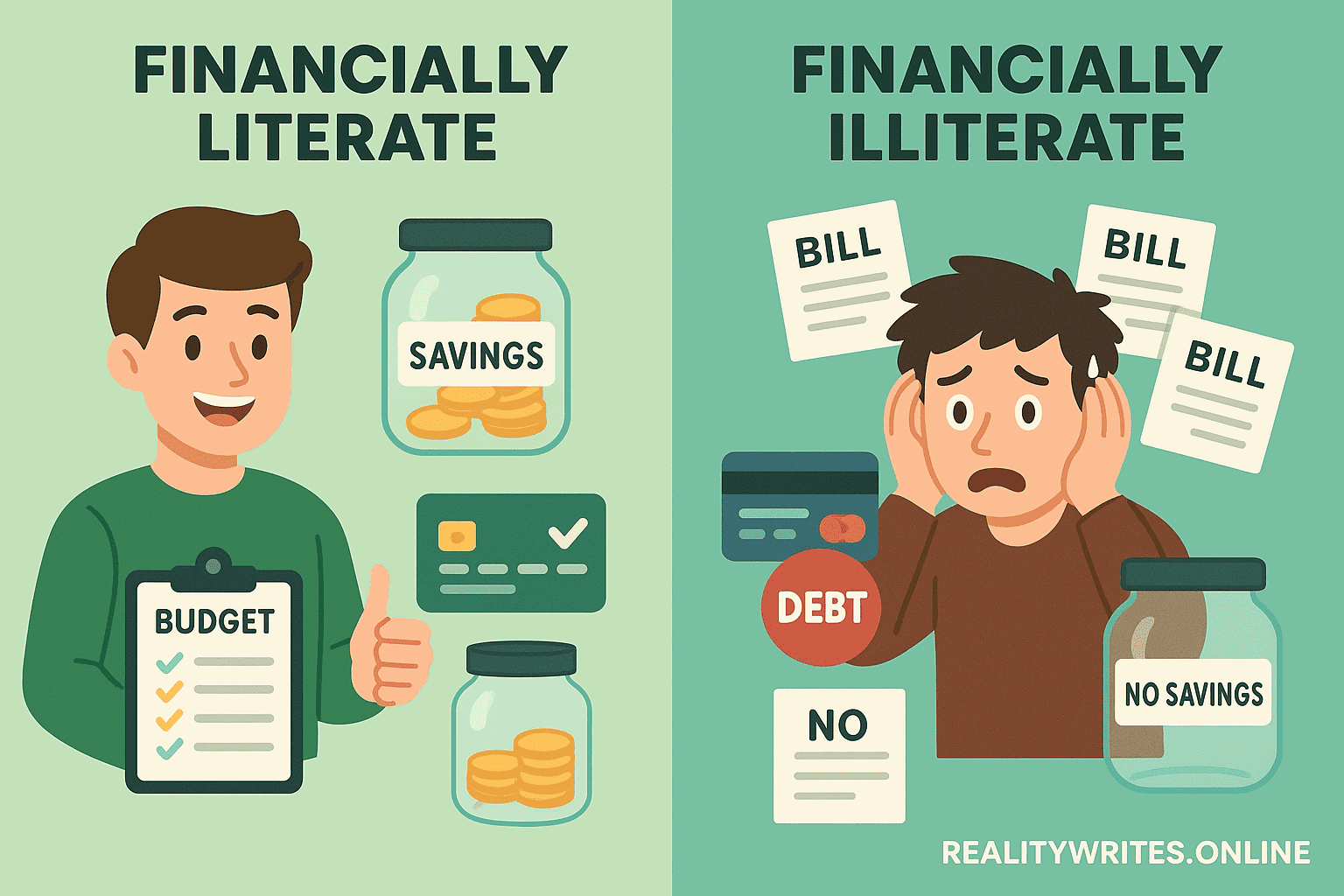

Financial Literacy vs. Financial Illiteracy: A Comparison

To see why financial literacy matters, consider the contrast between two friends. Alex is financially literate: they maintain a simple budget, save regularly, and understand how credit works. Jordan lacks financial knowledge: they don’t track spending, miss bill payments, and keep dipping into high-interest debt. Over time, Alex builds an emergency fund and good credit, while Jordan struggles with late fees and stress. This isn’t just anecdote – studies confirm that those with basic financial skills are far better off. For example, literate individuals are more likely to have retirement savings, pay off debt, and make informed choices about loans or insurance, whereas financial illiteracy often leads to overspending, unsustainable debt, and even bankruptcy.

Quick Comparison Table

| Feature | Financially Literate | Financially Illiterate |

|---|---|---|

| Budgeting | Follows a budget; knows where money goes | No plan; may overspend or live paycheck-to-paycheck |

| Emergency Savings | Has 3–6 months of expenses saved | Little or no savings; vulnerable to surprises |

| Debt Management | Uses debt wisely; pays on time | Carries high-interest debt; misses payments |

| Credit Score | Good credit habits; checks reports | Poor/unknown score; rare credit checks |

| Long-Term Planning | Plans for retirement, home ownership, education | No clear goals; not saving for future necessities |

| Decision Confidence | Feels in control and less stressed | Feels anxious about money; more financial stress |

These contrasts highlight why improving your financial knowledge is so crucial. Studies link higher financial literacy to greater confidence and security. In short, understanding money helps protect us from common pitfalls like debt traps and financial fraud.

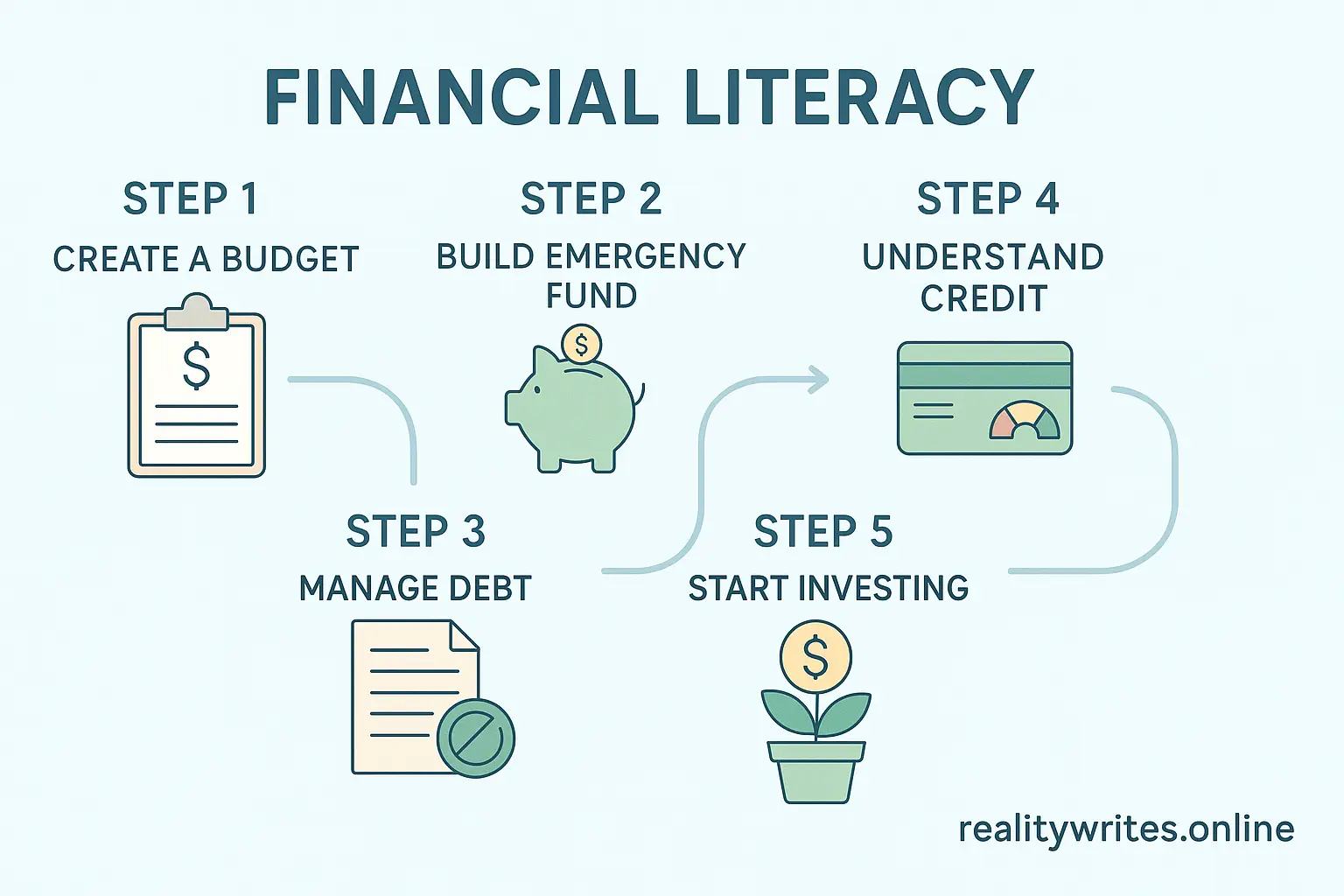

Key Insights: Basic Financial Literacy Tips for Beginners

Building financial literacy might sound daunting, but it simply means learning a few key habits and concepts. Here are some essential basic financial literacy tips to get started:

1. Create and Follow a Budget

List your income and expenses every month. A realistic budget shows where your money goes, helps you avoid overspending, and can guide saving goals. Tracking every dollar (even with a simple notebook or app) makes it easier to pay bills on time and set aside funds for savings or debt repayment. Remember: a budget isn’t about deprivation – it’s your roadmap to financial control.

2. Build an Emergency Fund

Aim to save at least 3–6 months’ worth of living expenses. Even small, regular contributions add up: treat saving as a non-negotiable expense. This “pay yourself first” approach means setting aside money right when you get paid.

3. Manage Debt Wisely

If you have loans or credit cards, use your budget to plan repayments. Pay off higher-interest debt first and avoid minimum payments. Keep track of balances and due dates. Smart debt management improves credit and saves money on interest.

4. Understand Credit

Check your credit report and score at least annually. A good credit score lowers borrowing costs, while mistakes can hurt for years. Make timely payments and keep balances low. Monitoring your credit report helps you catch errors and build strong credit.

5. Save and Invest Early

Even as a beginner, start saving for long-term goals. If your employer offers a retirement plan, contribute enough to get the match – it’s free money. You don’t need to be an expert investor: many beginners use index funds or bonds for low-risk growth. The key insight is time.

6. Keep Learning and Use Resources

Financial education is ongoing. Read articles, listen to finance podcasts, or take free courses. Government sites like MyMoney.gov offer basic tips and calculators. Use budgeting apps and track progress. Don’t hesitate to ask for help from advisors or knowledgeable friends.

Table: Summary of Beginner Tips

| Tip | Why It Matters |

| Budget & Track Expenses | Prevents overspending and shows where your money goes |

| Save Regularly | Builds a cushion for unexpected costs |

| Pay Off Debt | Reduces interest and improves credit |

| Learn Credit Basics | Saves on loans, prevents fraud, and builds creditworthiness |

| Start Saving/Investing | Leverages compound growth for future goals |

| Educate Yourself | Leads to smarter decisions and more financial confidence |

Conclusion: Take Control of Your Financial Education

Financial literacy isn’t optional – it’s a foundation for a secure life. By understanding basic concepts like budgeting, saving, and credit, you protect your peace of mind and unlock opportunities.

Ready to improve your financial literacy? Start with one action today: review last month’s bank statements or set up a simple budget. Each step builds confidence. If you found this guide helpful, consider subscribing for more beginner-friendly finance tips. You can also explore related articles on budgeting and saving. Remember, the importance of financial literacy is clear: less stress, more freedom, and a bright financial future awaits!

FAQ

What is financial literacy in simple words?

Financial literacy means understanding how money works — like how to budget, save, manage debt, and use credit — so you can make smart financial decisions in your daily life.

u003cstrongu003eHow do I start learning financial literacy as a beginner?u003c/strongu003e

Start by tracking your income and expenses, creating a monthly budget, learning how credit works, building an emergency fund, and exploring basic saving and investing concepts.

What are the 5 principles of financial literacy?

The five core principles are:u003cbru003eu003cstrongu003eEarn:u003c/strongu003e Know your income sourcesu003cbru003eu003cstrongu003eSpend:u003c/strongu003e Budget and control expensesu003cbru003eu003cstrongu003eSave:u003c/strongu003e Build savings for goals and emergenciesu003cbru003eu003cstrongu003eBorrow:u003c/strongu003e Use credit responsiblyu003cbru003eu003cstrongu003eProtect:u003c/strongu003e Understand risks and insurance