Introduction: The True Power of Passive Income

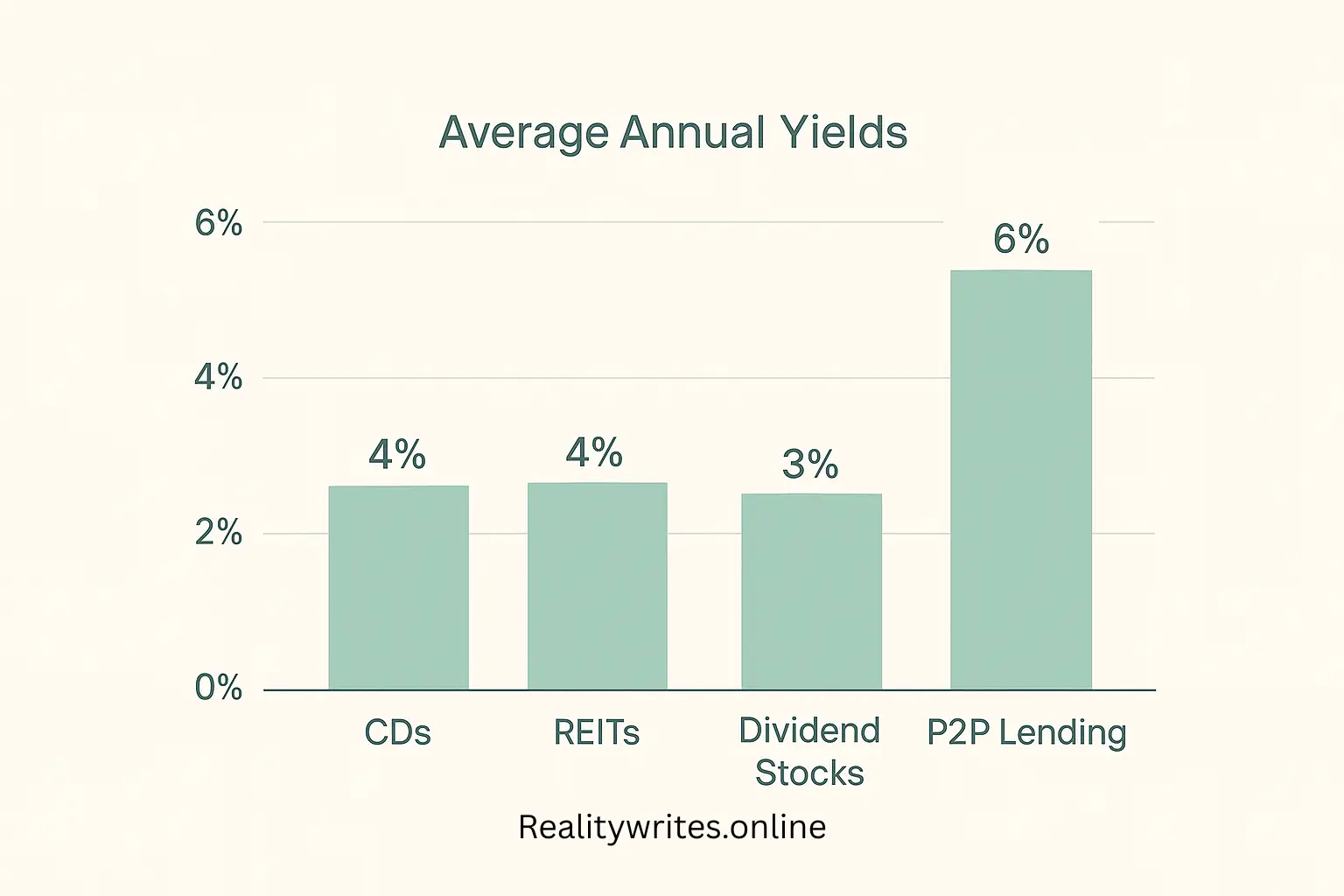

Imagine waking up to notifications that money has landed in your account—not because you traded your hours for dollars, but because something you set up weeks, months, or even years ago is quietly working in the background. That’s the promise of passive wealth, the dream of passive wealth: generating cash flow with minimal ongoing effort. But let’s be honest—true “set it and forget it” riches are rare. Most ways to make passive income require significant upfront effort, smart strategy, and realistic expectations. In this guide, we cut through the hype to explore what passive income truly is, dispel common myths, and dive into actionable passive earning ideas you can start building right now.

Table of Contents

Active Income vs. Passive Income: What’s the Difference?

| Aspect | Active Income | Passive Income |

|---|---|---|

| Effort After Startup | Continuous effort required | Minimal ongoing effort after initial setup |

| Time vs. Money Trade | You exchange hours for dollars | Money works for you; time becomes more flexible |

| Scalability | Limited by your availability | Often highly scalable—earnings grow without proportional time investment |

| Examples | Freelancing, consulting, retail work | Dividend stocks, rental properties, digital products |

This simple comparison helps clarify why the best ways to make passive income often feel so alluring—they free you from the relentless time-for-money trade.

What Is Passive Income? (It’s Not What You Think!)

The IRS defines passive income as earnings from a business in which you don’t materially participate, or from rental activities (with some nuances). For everyday folks, it boils down to this: passive income is money earned with little to no daily active involvement after the initial setup or investment.

Think of it like planting a tree. You dig the hole, plant the seed, and water it diligently at first (the active work). Over time, you just prune occasionally and enjoy the fruit (the passive returns).

Important clarifications:

- Not Completely Effortless: Expect upfront work—researching investments, writing a book, or setting up a rental.

- Not Instant Riches: Building streams takes time, patience, and often capital.

- Not Totally Hands-Off: Even the best streams need occasional monitoring, tweaking, or maintenance.

Why Bother? The Life-Changing Power of Passive Streams

Building passive wealth isn’t just about luxury; it’s about fundamental freedom:

- Time Liberation: Stop trading every hour for a paycheck. Passive income buys back your most precious asset: time.

- Financial Resilience: Multiple streams create a safety net during job loss, downturns, or health issues.

- Faster Goal Achievement: Fund retirement (early or traditional), travel, education, or side projects.

- Stress Reduction: Knowing money is coming in regardless of daily activity is incredibly liberating.

Debunking 3 Dangerous Myths About Passive Income

Before diving into ideas, let’s shatter common illusions:

- Myth: “It’s Easy Money.”

Reality: The initial phase is often demanding—creating a high-quality online course or researching dividend stocks takes serious effort. - Myth: “You Need Tons of Money to Start.”

Reality: Many passive income ideas, like affiliate marketing or digital products, can begin with minimal cash—leveraging your skills and time instead. - Myth: “Once Set Up, It Runs Forever.”

Reality: Markets change, algorithms shift, rentals need maintenance. Expect to spend some ongoing time managing or updating your streams.

12 Realistic Passive Income Ideas You Can Start Now

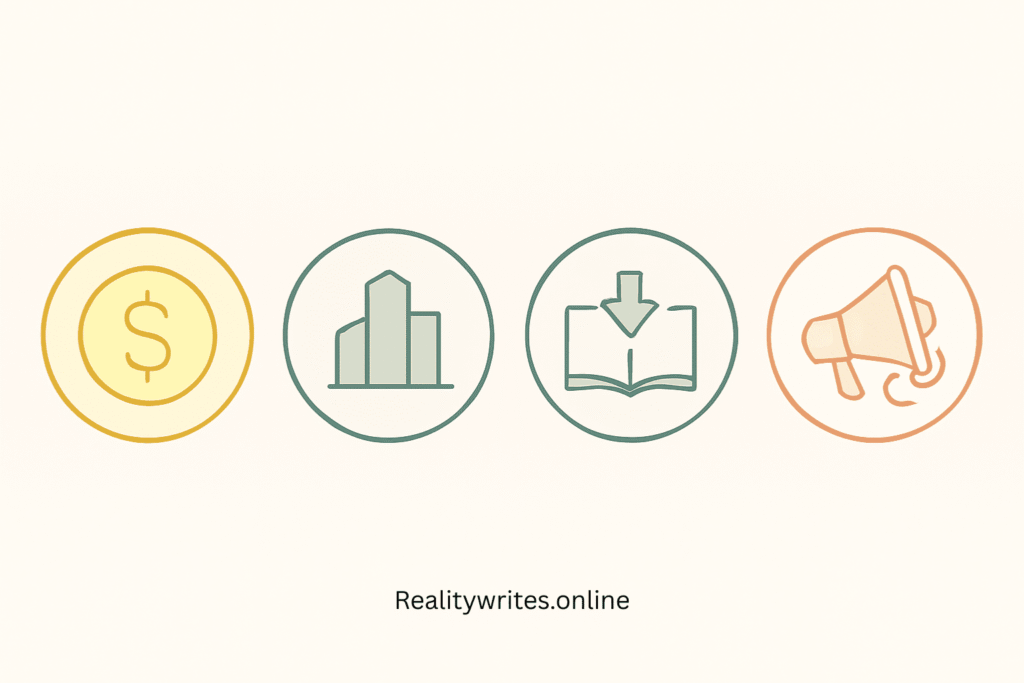

Here are some of the best ways to make passive income, ranked by upfront effort, expected returns, and typical risk. Use this table as a roadmap to find your ideal path:

| Idea | Upfront Effort | Ongoing Effort | Potential Returns | Risk Level | Capital Needed |

| Dividend Stock Investing | Medium (research) | Very Low | 2–5% yield | Medium | Medium-High |

| Real Estate Investment Trusts (REITs) | Medium | Low | ~4% yield | Medium | Medium |

| Rental Properties (Traditional) | High (purchase/setup) | Medium-High | 6–10% yield | High | Very High |

| Short-Term Rentals (Airbnb, etc.) | High | High | 8–12% yield | High | Very High |

| Peer-to-Peer Lending | Low | Low | 5–8% APR | Medium-High | Medium |

| High-Yield Savings & CDs | Very Low | Very Low | 4–5% APY | Very Low | Low-Medium |

| Digital Products (eBooks, Courses) | Very High | Low-Medium | Variable | Medium | Low |

| Affiliate Marketing | High | Low-Medium | Variable (1–50%) | Medium | Very Low |

| Print-on-Demand Merchandise | Medium | Low-Medium | Variable | Medium | Low |

| Index Fund Investing | Low | Very Low | 7–10% long-term | Medium | Medium |

| YouTube & Podcast Royalties | Very High | Medium | Variable | Medium | Low |

| App/SaaS Products | Very High | Low-Medium | 10–100%+ | High | Medium-High |

Deep Dive: Top 4 Strategies

1. Dividend Stock Investing: The Classic Wealth Builder

What it is: Buying shares in companies that distribute a portion of profits (dividends) regularly.

How to start: Open a brokerage account (e.g., Fidelity, Charles Schwab). Research dividend-paying companies with long track records (Dividend Aristocrats). Enable dividend reinvestment (DRIP) for compounding.

Realistic expectations: Yields average 1.5–4% annually. Significant capital required for meaningful monthly payouts.

2. REITs: Real Estate Without Landlord Headaches

What it is: Funds that pool investor capital to buy and manage income-producing properties.

How to start: Purchase REIT shares via any stock brokerage. Consider specialized ETFs like Vanguard Real Estate ETF (VNQ).

Realistic expectations: Approximately 4% yields, market volatility applies. Low maintenance.

3. Digital Products: Leverage Your Unique Expertise

What it is: Creating eBooks, online courses, templates, or digital art that can be sold repeatedly.

How to start: Identify a niche problem or skill gap. Use Amazon KDP for eBooks, Teachable or Udemy for courses, Gumroad for downloads.

Realistic expectations: High upfront time investment. Sales scale with marketing and SEO. Potential for multi-thousand-dollar annual royalties.

4. Affiliate Marketing: Monetize Your Recommendations

What it is: Earning commissions by promoting other brands’ products via unique tracking links.

How to start: Join networks like Amazon Associates, ShareASale, or CJ Affiliate. Create niche content—blogs, YouTube videos, social posts—and embed affiliate links.

Realistic expectations: Depend on traffic volume and conversion rates. Commissions range 1–50%. Audience trust is key.

Key Insights & Pitfalls to Avoid

- Upfront Effort Matters: Even “passive” streams require initial work and strategy.

- Diversify Your Streams: Don’t put all your eggs in one basket—combine low-risk (e.g., high-yield savings) with higher-return options.

- Mind the Taxes: Different income types (ordinary vs. capital gains vs. qualified dividends) have varying tax treatments; consult a tax professional.

- Beware Scams: If it sounds too good to be true—pyramid schemes, “overnight millionaire” pitches—steer clear.

- Reinvest Earnings: Let compounding do the heavy lifting by reinvesting profits whenever possible.

Conclusion: Your Path to Building Passive Wealth

True passive wealth isn’t magic—it’s the product of strategic planning, consistent effort, and patience. Start by choosing one or two methods that align with your skills, time, and capital. Automate transfers, set up tracking, and commit to learning as you go. Over months and years, you’ll see those seeds sprout into meaningful streams of passive wealth.

Ready to take action?

- Pick your first stream—maybe opening a high-yield savings account or drafting an eBook outline.

- Download our free Passive Income Tracker to monitor your progress.

- Subscribe to our newsletter for exclusive deep dives and case studies.

- Share your journey in the comments—what passive Wealth ideas resonate with you most?

Let’s build freedom together—one stream at a time.

FAQ

What is passive income and how does it work?

Passive income is money earned with little to no ongoing effort after the initial setup. It works by building income-generating assets—like investments, digital products, or rental properties—that continue to earn money over time without constant active work. Think of it like planting a tree: you put in work upfront, then harvest the rewards later.

What are the best ways to make passive income in 2025?

Some of the best ways to make passive income in 2025 include:

Dividend stock investing

Creating and selling digital products

Affiliate marketing

Rental properties (traditional or Airbnb)

High-yield savings accounts

Each method varies in startup cost, effort, and risk—choose based on your goals and resources.

How much money do I need to start earning passive earnings?

You can start some passive income streams with little or no money—like affiliate marketing or selling digital downloads. Others, like dividend investing or rental income, may require hundreds or thousands of dollars upfront. It depends on the strategy you choose and whether you’re investing time, money, or both.

Is passive wealth really passive?

Not entirely. Most passive income ideas require significant upfront effort or initial investment. And even after setup, some maintenance is needed—whether it’s updating digital content, monitoring investments, or managing rental tenants. The goal is to minimize daily work, not eliminate it completely.

What’s the difference between active and passive income?

Active income requires ongoing effort (e.g., salary, freelance work), while passive income is generated from sources that run with minimal involvement (e.g., rental income, royalties, stock dividends). The key difference is how much time you must exchange to earn.