Managing your money without a clear plan often leads to confusion, overspending, or missing savings goals. That’s where zero-based budgeting comes in — a simple yet powerful method that helps you take full control of your income. In this budgeting style, every single rupee is given a purpose, so nothing goes to waste. Whether you’re trying to save more, pay off debt, or just understand where your money is going, zero-based budgeting can help you reset your finances and build smarter habits — starting from zero.

Table of Contents

What is Zero-Based Budgeting?

Zero-based budgeting is where we use zero as the base to start a budget year. All the income for the budget year is used in the expenses of the budget. In simple words, all the earnings of a year are spent in planned areas like needs, wants, savings, and paying off debts — which means every penny is accounted for.

In other words, zero-based budgeting means:

Total income of the budget year – Total expenses of the year = 0

Example:

Mr. John earns $5,000 each month.

- Rent: $1,500

- Food: $1,000

- Bills: $500

- Transportation: $500

- Investment: $750

- Savings: $750

Total = $5,000 spent, which means he spent every penny with a clear purpose.

Explanation

Zero-based budgeting is a technique that helps an individual, business, or company plan how to spend each penny during a specific period — by dividing it into needs, wants, savings, and debt payments. It helps start every new budget from a zero base, meaning nothing is carried over and everything is re-evaluated from scratch.

Unlike traditional budgeting, where you base your new budget on last month’s habits, zero-based budgeting requires you to justify every expense — no matter how big or small. The goal is to make sure that your total income minus total expenses equals zero, meaning every rupee or dollar is assigned a specific purpose.

This method encourages:

- Intentional spending

- Better control over money

- Eliminating unnecessary expenses

- Improved saving and debt management

Whether you’re a student, a freelancer, or a business owner, zero-based budgeting helps you stay focused, reduce waste, and make smarter financial decisions.

How its works

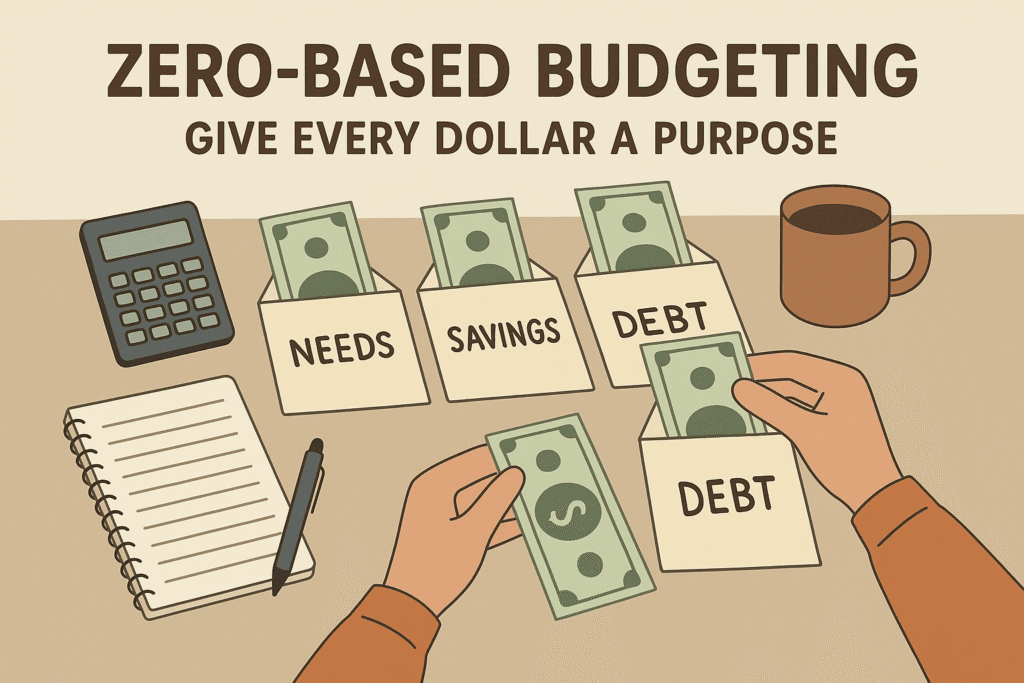

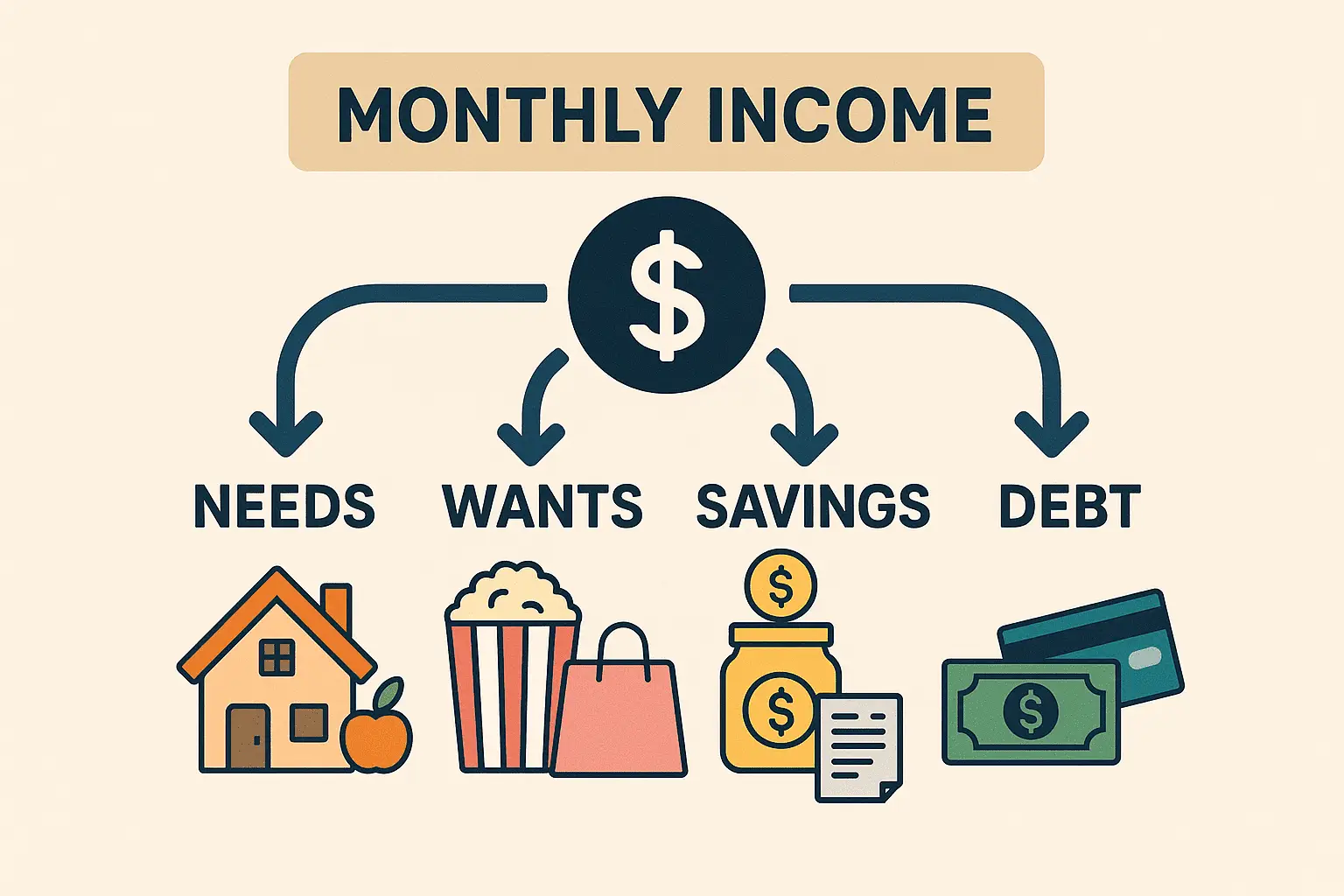

In zero-based budgeting, you divide your income — every single penny — until your balance becomes zero. You assign your money to four main categories:

1. Needs

These are the things you use daily and are essential for survival. Without them, living comfortably is difficult. Examples include:

- Rent or housing

- Food and groceries

- Utility bills

- Transportation

2. Wants

Wants are things you don’t need daily, but they add value or comfort to your life. Sometimes they feel important, but they are not essentials. Examples include:

- Dining out

- Entertainment or Netflix

- Shopping for non-essentials

- Vacations

3. Savings

This is the money you set aside from your income to build an emergency fund, buy future assets, or plan for financial goals. Saving helps you stay financially secure and prepares you for unexpected situations.

4. Debt Payments

If you’ve taken a loan, the amount you owe is called debt. In your budget, you should include repayments toward any borrowed money, such as:

- Personal loans

- Credit card debt

- Education loans

| Category | Meaning | Examples |

| Needs | Essential things you use daily; survival would be difficult without them. | Rent, groceries, utilities, transport |

| Wants | Non-essential but desirable items; add comfort or enjoyment to life. | Dining out, shopping, Netflix, vacations |

| Savings | Money you set aside for future needs or emergencies. | Emergency fund, buying assets, long-term goals |

| Debt Payments | Repayment of money you borrowed. | Personal loans, credit cards, education loans |

Traditional Budgeting vs Zero-Based Budgeting

When it comes to managing money, two common approaches are traditional budgeting and zero-based budgeting (ZBB). Both have their own strengths, but they work in very different ways.

Traditional budgeting is based on past spending. You look at how much you spent last month or last year and plan your new budget by adjusting those numbers slightly. It’s quicker and easier but often includes unnecessary expenses because it assumes past behaviour should continue.

Zero-based budgeting, on the other hand, starts from scratch every month. Instead of copying last month’s numbers, you plan how to spend every rupee from your income — dividing it into categories like needs, wants, savings, and debt payments. The goal is to make sure your total income minus total expenses equals zero, meaning every penny is assigned a job. This method takes more effort but gives you complete control over your finances.

Comparison Table: Traditional Budgeting vs Zero-Based Budgeting

| Feature | Traditional Budgeting | Zero-Based Budgeting (ZBB) |

| Starting Point | Based on previous spending habits | Starts from zero every month or period |

| Expense Review | Only major changes are reviewed | Every expense must be justified |

| Budgeting Approach | Estimates based on history | Detailed plan from scratch |

| Control Level | Moderate control | High control over every rupee/dollar |

| Savings Method | Whatever is left after spending | Planned and prioritized from the start |

| Time Required | Less time to prepare | More time, but higher financial clarity |

| Ideal For | Stable earners or those with predictable expenses | People with irregular income or serious about managing money tightly |

| Main Goal | Maintain and adjust old patterns | Plan each new budget with intention |

Pros and Cons of Zero-Based Budgeting

Zero-based budgeting (ZBB) can be a powerful tool for managing money more intentionally. But like any budgeting method, it has both strengths and weaknesses. Here’s a clear breakdown:

Pros of Zero-Based Budgeting

- Complete Control Over Every Rupee

- You decide exactly where your money goes — nothing is left unplanned.

- Encourages Financial Discipline

- Every expense must be justified, which helps eliminate wasteful spending.

- Improves Savings & Debt Repayment

- Savings and loan repayments are planned first — not treated as leftovers.

- Flexible for All Income Levels

- Works for students, freelancers, families, or anyone who wants better money habits.

- Makes You More Financially Aware

- You become more conscious of your spending patterns and priorities.

Cons of Zero-Based Budgeting

- Time-Consuming to Set Up

- It requires more effort each month to plan and track every category.

- Can Feel Strict or Rigid

- Some people find it hard to adjust if unexpected expenses come up.

- Not Ideal for Irregular or Unstable Incomes (Without Adjustments)

- Freelancers or variable earners may need to customize it carefully.

- Needs Consistent Tracking

- You must monitor your spending closely, or the plan can fall apart.

If you’re serious about managing your money and reaching financial goals, zero-based budgeting is one of the most effective methods — but it demands focus and consistency.

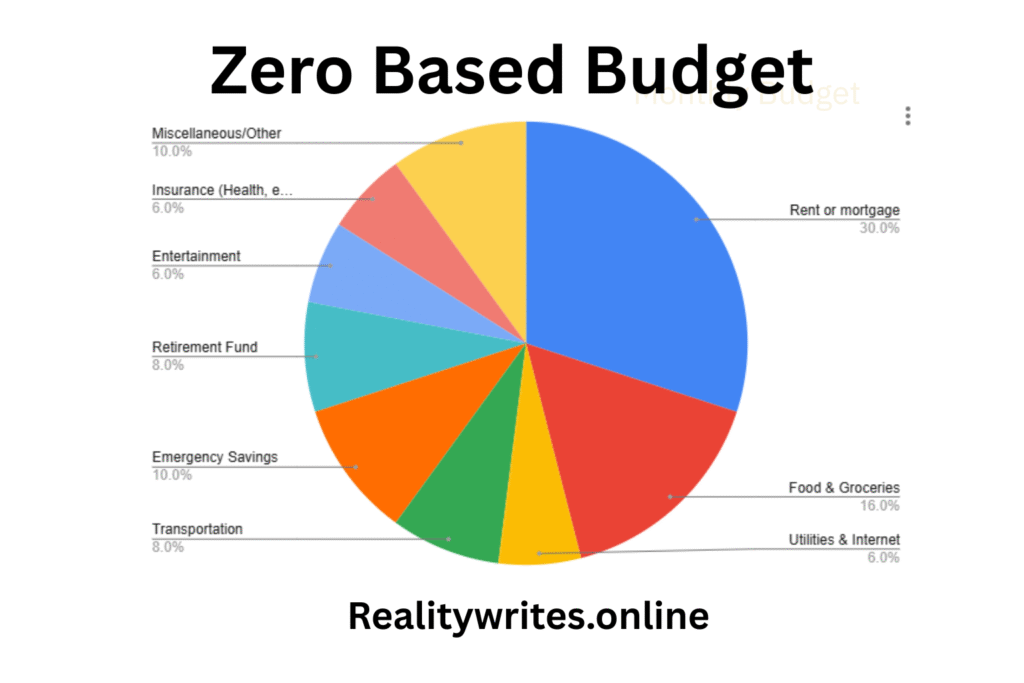

Example of Zero-Based Budgeting

Let’s say Mr. John earns $5,000 per month. Using the zero-based budgeting method, he plans where every dollar will go, so nothing is left unassigned. Here’s how he could divide his income:

| Category | Amount (USD) |

| Rent or mortgage | $1,500 |

| Food & Groceries | $800 |

| Utilities & Internet | $300 |

| Transportation | $400 |

| Emergency Savings | $500 |

| Retirement Fund | $400 |

| Entertainment | $300 |

| Insurance (Health, etc.) | $300 |

| Miscellaneous/Other | $500 |

| Total | $5,000 |

In this case, every dollar is assigned a specific role, which means Mr. John’s income minus expenses equals zero. That’s the goal of zero-based budgeting: full control, no waste, and intentional money management.

Top Zero-Based Budgeting Apps in 2025

If you’re following the zero-based budgeting method and want tools to help you plan every dollar, here are the best apps to consider:

1. You Need a Budget (YNAB)

Best For: Serious budgeters who want full financial control

- Zero-based budgeting built-in

- Advanced reports and goal tracking

- Platforms: iOS, Android, Web

- Website: youneedabudget.com

2. Every Dollar

Best For: Beginners using zero-based or envelope-style budgeting

- Simple drag-and-drop interface

- Bank sync and custom recommendations (paid version)

- Platforms: iOS, Android, Web

- Website: everydollar.com

3. Good budget

Best For: Envelope budgeting with a zero-based mindset

- Virtual envelope system for managing expenses

- Supports multiple devices, ideal for couples and families

- Platforms: iOS, Android, Web

- Website: goodbudget.com

4. Pocket Guard

Best For: Automatic budgeting and spending control

- Tracks how much you can safely spend

- Helps manage bills, subscriptions, and savings goals

- Platforms: iOS, Android

- Website: pocketguard.com

5. Zeta (for Couples)

Best For: Couples managing joint and individual finances

- Budgeting for shared and personal expenses

- Includes bill tracking, financial goals, and automation

- Platforms: iOS, Android

- Website: askzeta.com

Bonus: Free Tools for Manual Zero-Based Budgeting

If you prefer budgeting without apps, you can use:

- Google Sheets or Excel budget templates

- Printable budgeting worksheets

- Notion templates or simple pen-and-paper methods

Conclusion

Zero-based budgeting isn’t just about balancing your income and expenses — it’s about being intentional with every dollar or rupee you earn. By assigning a purpose to each penny, you create a clear plan for your money, reduce wasteful spending, and stay focused on your financial goals.

Whether you’re trying to save more, pay off debt, or take control of irregular income, this method gives you clarity, control, and confidence. Yes, it takes time and consistency, but the results are worth it — especially when you’re serious about financial growth.

If you’re ready to take charge of your money, zero-based budgeting is a smart place to start. Choose a method — use an app, a spreadsheet, or just a notebook — and build your budget from zero today.

Ready to Take Control of Your Finances?

Start building your zero-based budget today and give every dollar a purpose. Whether you’re a beginner or looking to improve your money habits, this method will help you stay focused, save more, and spend smarter.

Need help getting started?

- Download our free Zero-Based Budget Template

- Explore our post on How to Build an Emergency Fund

- Read Monthly Budget Planner: A Guide That Actually Works

- Try out the best Budgeting Apps for 2025

Still have questions? Drop a comment or reach out — we’re here to help you master your money, one step at a time.